Summary

We study non-convex Hamilton-Jacobi equations in the presence of gradient constraints and produce new, optimal, regularity results for the solutions. A distinctive feature of those equations regards the existence of a lower bound to the norm of the gradient; it competes with the elliptic operator governing the problem, affecting the regularity of the solutions. This class of models relates to various important questions and finds applications in several areas; of particular interest is the modeling of optimal dividends problems for multiple insurance companies in risk theory and singular stochastic control in reversible investment models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

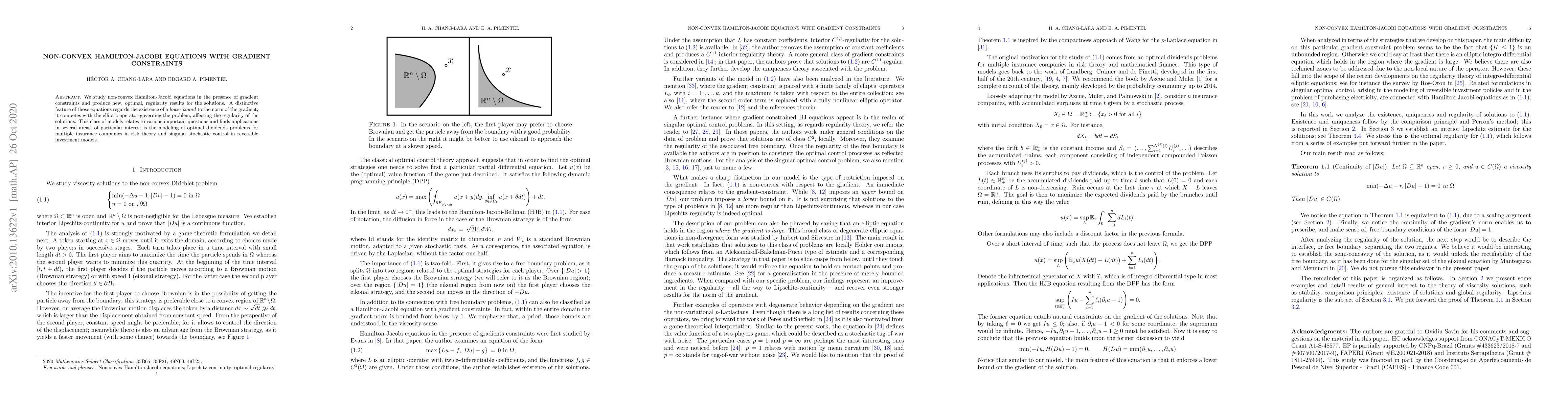

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)