Summary

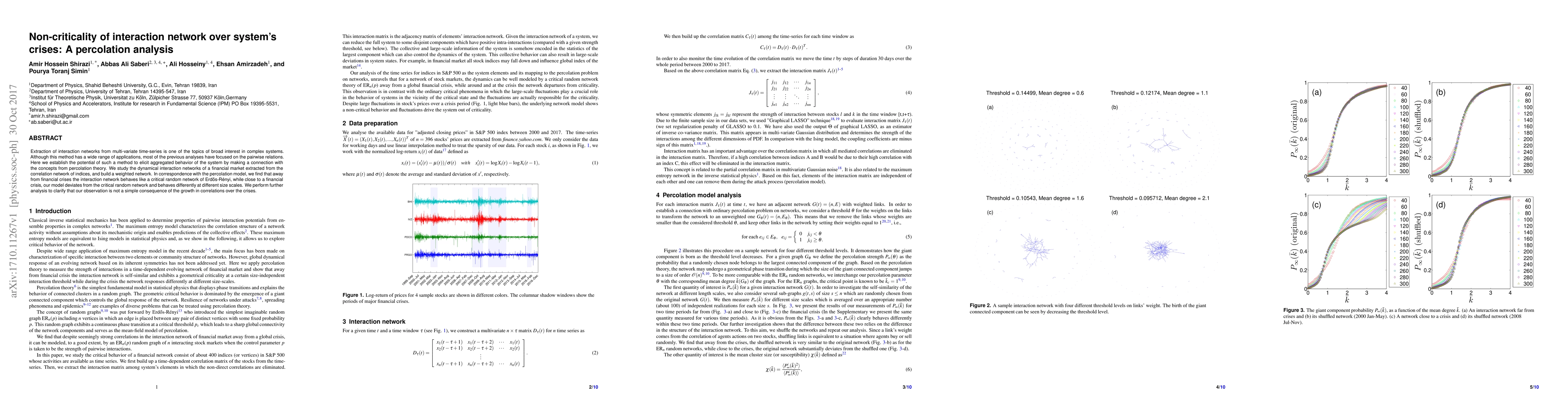

Extraction of interaction networks from multi-variate time-series is one of the topics of broad interest in complex systems. Although this method has a wide range of applications, most of the previous analyses have focused on the pairwise relations. Here we establish the potential of such a method to elicit aggregated behavior of the system by making a connection with the concepts from percolation theory. We study the dynamical interaction networks of a financial market extracted from the correlation network of indices, and build a weighted network. In correspondence with the percolation model, we find that away from financial crises the interaction network behaves like a critical random network of Erd\H{o}s-R\'{e}nyi, while close to a financial crisis, our model deviates from the critical random network and behaves differently at different size scales. We perform further analysis to clarify that our observation is not a simple consequence of the growth in correlations over the crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)