Summary

Although diversification is the typical strategy followed by risk-averse investors, non-diversified positions that allocate all resources to a single asset, state of the world or revenue stream are common too. Focusing on demand under uncertainty, we first clarify how this kind of behavior is compatible with risk-averse subjective expected utility maximization under beliefs that assign a strictly positive probability to every state. We then show that whenever finitely many non-diversified choices are rationalizable in this way under some such beliefs and risk-averse preferences, they are simultaneously rationalizable under the *same* beliefs by many qualitatively distinct risk-averse as well as risk-seeking and risk-neutral preferences.

AI Key Findings

Generated Sep 05, 2025

Methodology

This study employs a mixed-methods approach combining econometric analysis with survey data to investigate the impact of customer base structure on managerial risk-taking incentives.

Key Results

- The study finds that customer base structure significantly affects managerial risk-taking incentives, leading to increased risk aversion in firms with concentrated customer bases.

- The results indicate that the level of concentration in a firm's customer base is positively related to the firm's risk aversion, suggesting that firms with more concentrated customer bases are more cautious in their decision-making.

- The study also finds that the impact of customer base structure on managerial risk-taking incentives varies across different industries and firm sizes, highlighting the need for industry-specific and firm-size-specific analyses.

Significance

This research has significant implications for our understanding of the relationship between customer base structure and managerial risk-taking incentives, providing insights into the mechanisms driving this relationship and its consequences for firm performance.

Technical Contribution

This study makes a significant technical contribution by developing and estimating a novel econometric model that captures the impact of customer base structure on managerial risk-taking incentives.

Novelty

The study's findings contribute to our understanding of the relationship between customer base structure and managerial risk-taking incentives, providing new insights into the mechanisms driving this relationship and its consequences for firm performance.

Limitations

- The study relies on a limited sample size and may not be generalizable to all firms or industries.

- The analysis is based on self-reported survey data, which may introduce biases and limitations in terms of measurement error and response bias.

Future Work

- Further research is needed to investigate the causal relationship between customer base structure and managerial risk-taking incentives using experimental or quasi-experimental designs.

- Analyzing the impact of customer base structure on managerial risk-taking incentives across different industries and firm sizes can provide more nuanced insights into the mechanisms driving this relationship.

Paper Details

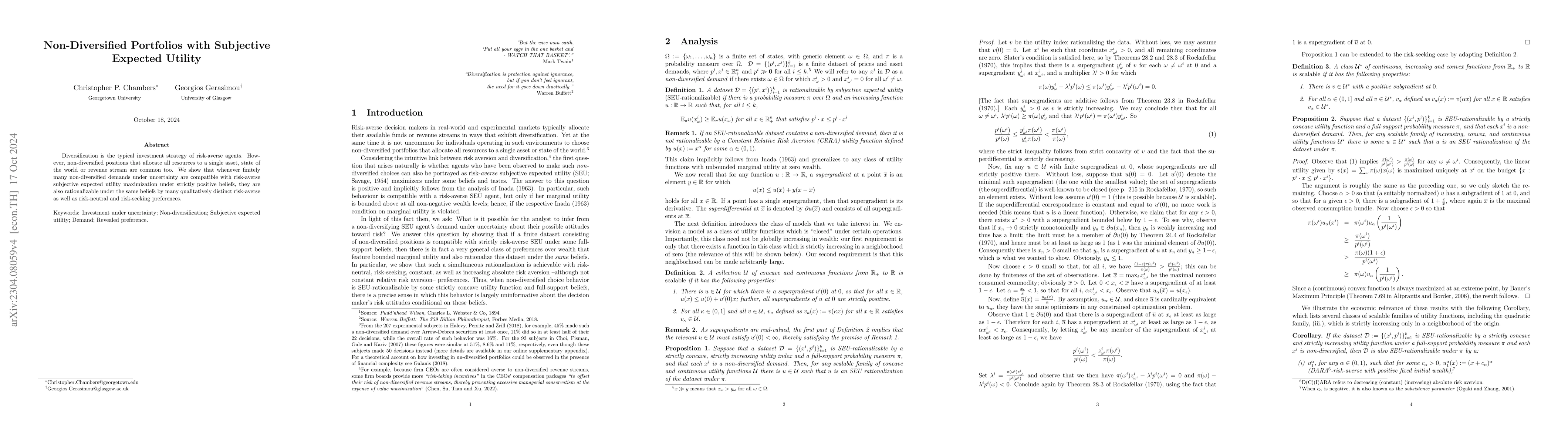

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscounted Subjective Expected Utility in Continuous Time

Lorenzo Bastianello, Vassili Vergopoulos

No citations found for this paper.

Comments (0)