Authors

Summary

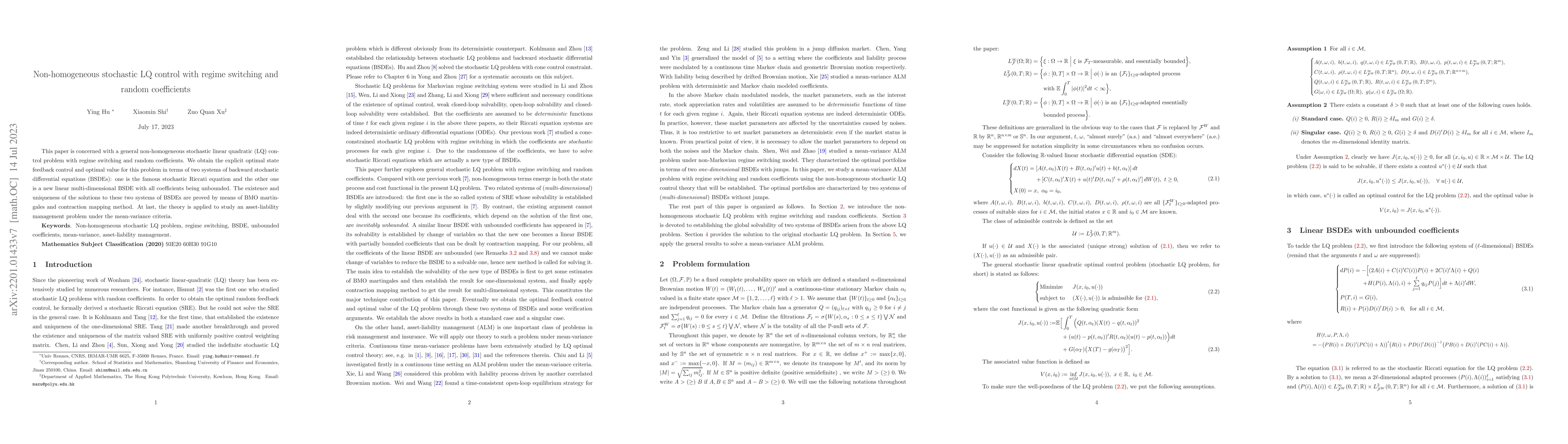

This paper is concerned with a general non-homogeneous stochastic linear quadratic (LQ) control problem with regime switching and random coefficients. We obtain the explicit optimal state feedback control and optimal value for this problem in terms of two systems of backward stochastic differential equations (BSDEs): one is the famous stochastic Riccati equation and the other one is a new linear multi-dimensional BSDE with all coefficients being unbounded. The existence and uniqueness of the solutions to these two systems of BSDEs are proved by means of BMO martingales and contraction mapping method. At last, the theory is applied to study an asset-liability management problem under the mean-variance criteria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstrained stochastic LQ control on infinite time horizon with regime switching

Ying Hu, Xiaomin Shi, Zuo Quan Xu

Non-homogeneous stochastic linear-quadratic optimal control problems with multi-dimensional state and regime switching

Yuyang Chen, Peng Luo

Constrained stochastic LQ control with regime switching and application to portfolio selection

Ying Hu, Xiaomin Shi, Zuo Quan Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)