Summary

In order to calculate the unobserved volatility in conditional heteroscedastic time series models, the natural recursive approximation is very often used. Following \cite{StraumannMikosch2006}, we will call the model \emph{invertible} if this approximation (based on true parameter vector) converges to the real volatility. Our main results are necessary and sufficient conditions for invertibility. We will show that the stationary GARCH($p$, $q$) model is always invertible, but certain types of models, such as EGARCH of \cite{Nelson1991} and VGARCH of \cite{EngleNg1993} may indeed be non-invertible. Moreover, we will demonstrate it's possible for the pair (true volatility, approximation) to have a non-degenerate stationary distribution. In such cases, the volatility estimate given by the recursive approximation with the true parameter vector is inconsistent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

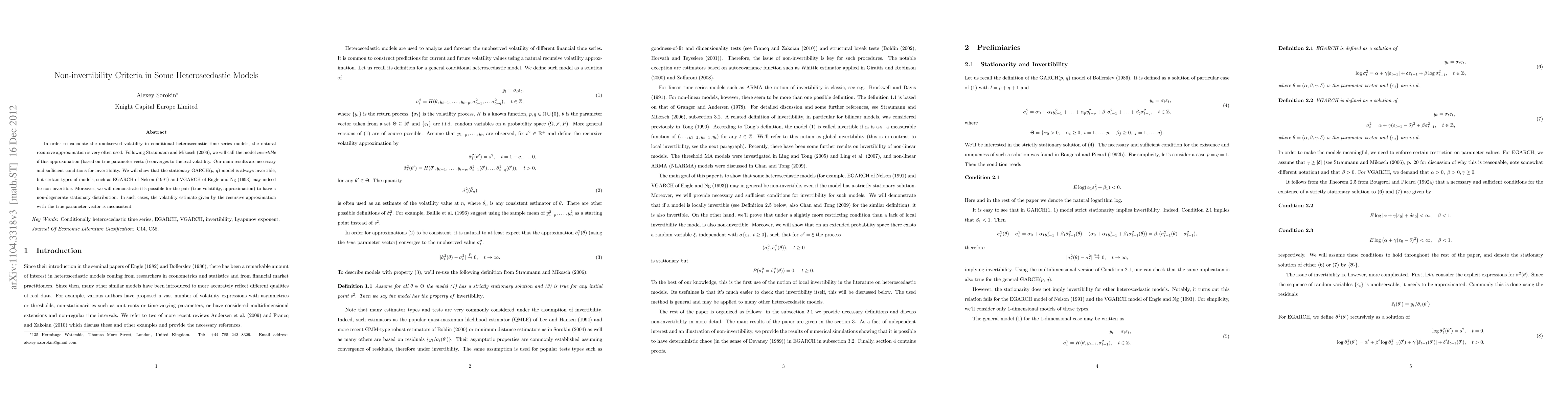

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)