Authors

Summary

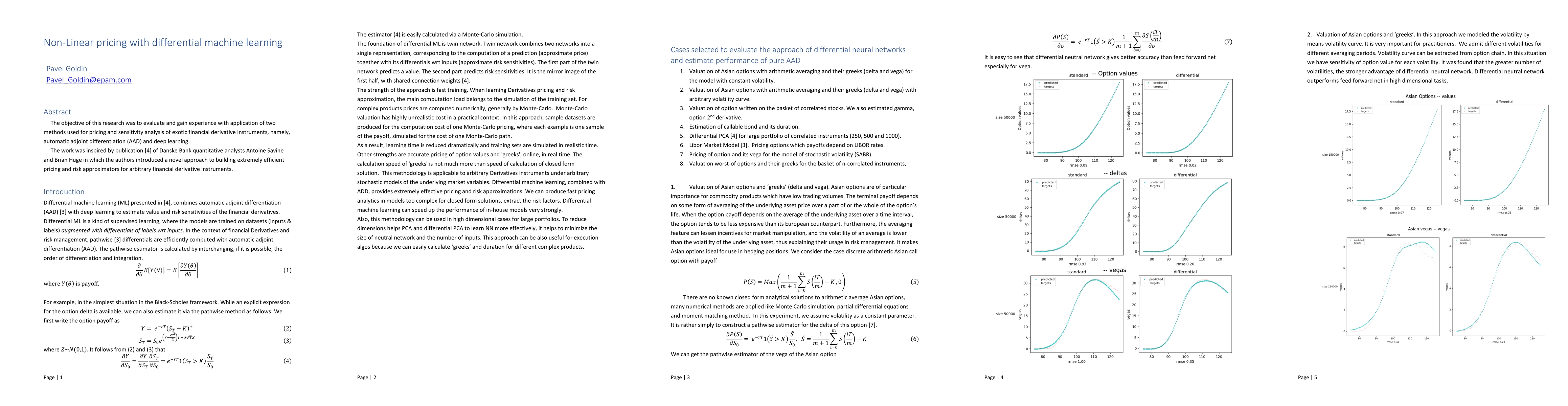

The objective of this research was to evaluate and gain experience with application of two methods used for pricing and sensitivity analysis of exotic financial derivative instruments, namely, automatic adjoint differentiation (AAD) and deep learning. The work was inspired by publication of Danske Bank quantitative analysts Antoine Savine and Brian Huge in which the authors introduced a novel approach to building extremely efficient pricing and risk approximators for arbitrary financial derivative instruments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParametric Differential Machine Learning for Pricing and Calibration

Bernhard Hientzsch, Arun Kumar Polala

No citations found for this paper.

Comments (0)