Summary

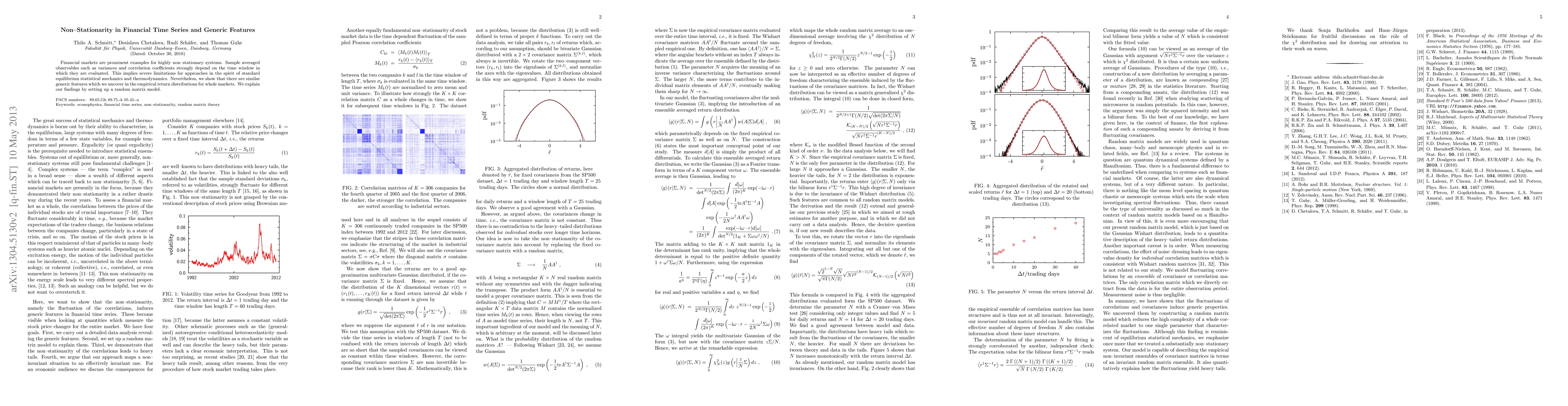

Financial markets are prominent examples for highly non-stationary systems. Sample averaged observables such as variances and correlation coefficients strongly depend on the time window in which they are evaluated. This implies severe limitations for approaches in the spirit of standard equilibrium statistical mechanics and thermodynamics. Nevertheless, we show that there are similar generic features which we uncover in the empirical return distributions for whole markets. We explain our findings by setting up a random matrix model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTimeBridge: Non-Stationarity Matters for Long-term Time Series Forecasting

Yifan Hu, Tao Dai, Peiyuan Liu et al.

Non-stationary Transformers: Exploring the Stationarity in Time Series Forecasting

Yong Liu, Haixu Wu, Mingsheng Long et al.

Stationarity of Manifold Time Series

Dehan Kong, Zhenhua Lin, Junhao Zhu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)