Summary

This paper is concerned with a non-zero sum differential game problem of an anticipated forward-backward stochastic differential delayed equation under partial information. We establish a necessary maximum principle and sufficient verification theorem of the game system by virtue of the duality and convex variational method. We apply the theoretical results and stochastic filtering theory to study a linear-quadratic game system and derive the explicit form of the Nash equilibrium point and discuss the existence and uniqueness in particular cases. As an application, we consider a time-delayed pension fund manage problem with nonlinear expectation and obtain the Nash equilibrium point.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

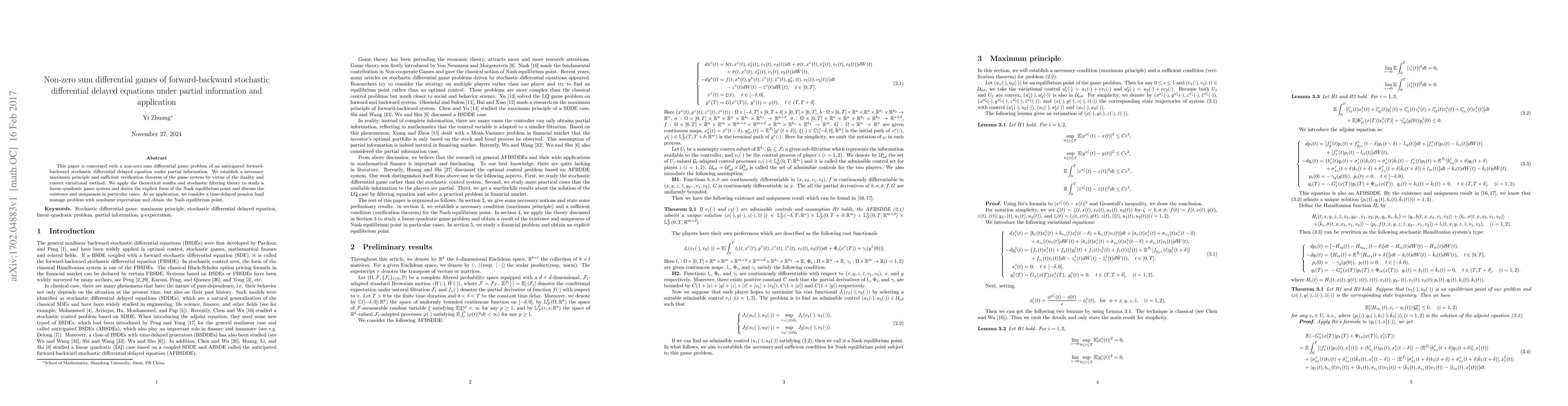

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)