Authors

Summary

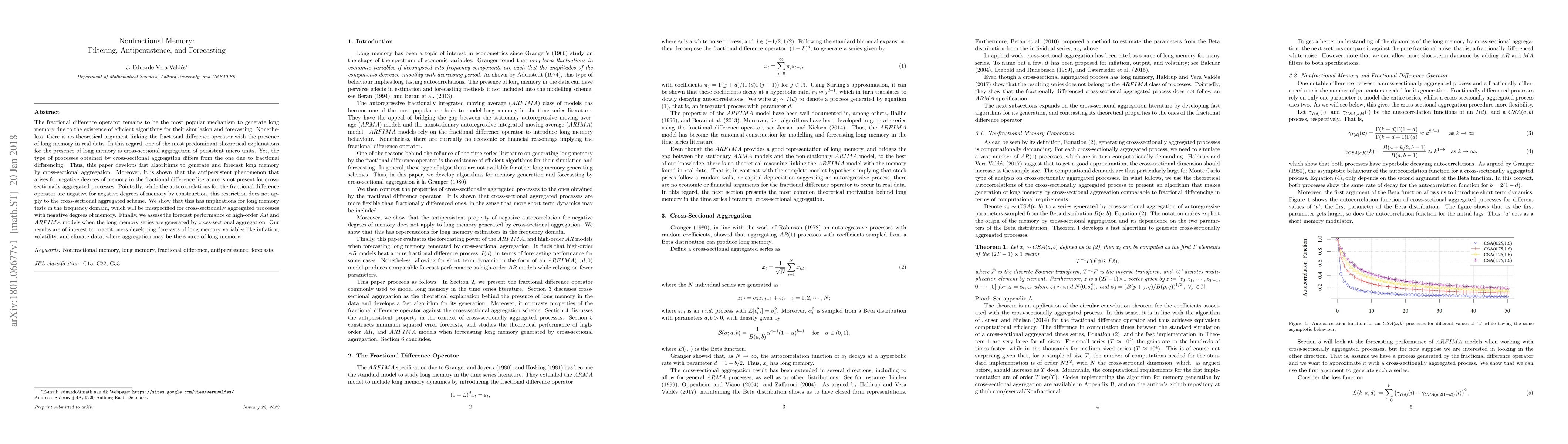

The fractional difference operator remains to be the most popular mechanism to generate long memory due to the existence of efficient algorithms for their simulation and forecasting. Nonetheless, there is no theoretical argument linking the fractional difference operator with the presence of long memory in real data. In this regard, one of the most predominant theoretical explanations for the presence of long memory is cross-sectional aggregation of persistent micro units. Yet, the type of processes obtained by cross-sectional aggregation differs from the one due to fractional differencing. Thus, this paper develops fast algorithms to generate and forecast long memory by cross-sectional aggregation. Moreover, it is shown that the antipersistent phenomenon that arises for negative degrees of memory in the fractional difference literature is not present for cross-sectionally aggregated processes. Pointedly, while the autocorrelations for the fractional difference operator are negative for negative degrees of memory by construction, this restriction does not apply to the cross-sectional aggregated scheme. We show that this has implications for long memory tests in the frequency domain, which will be misspecified for cross-sectionally aggregated processes with negative degrees of memory. Finally, we assess the forecast performance of high-order $AR$ and $ARFIMA$ models when the long memory series are generated by cross-sectional aggregation. Our results are of interest to practitioners developing forecasts of long memory variables like inflation, volatility, and climate data, where aggregation may be the source of long memory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)