Summary

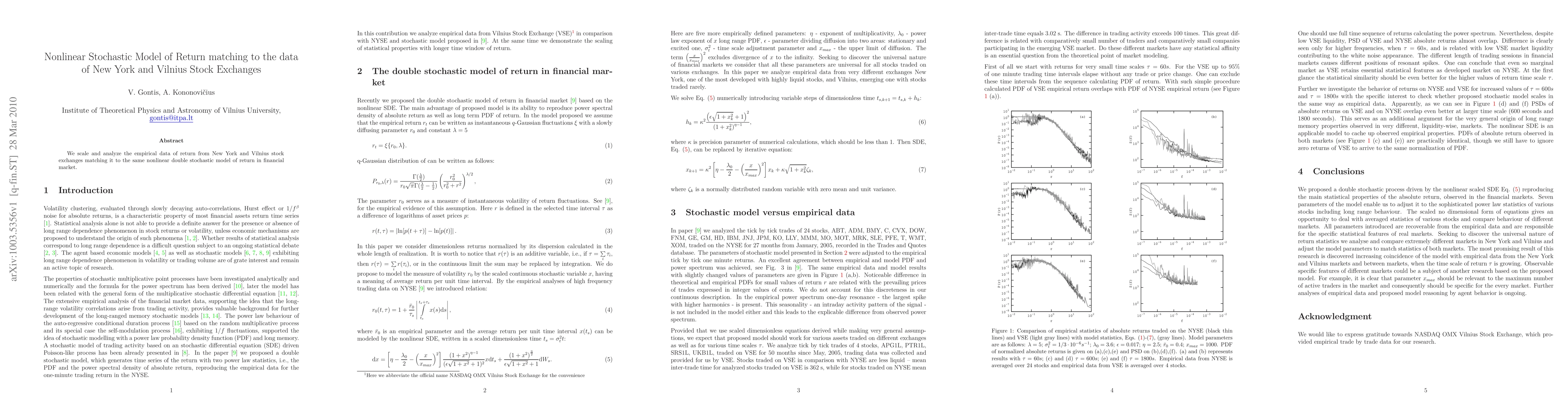

We scale and analyze the empirical data of return from New York and Vilnius stock exchanges matching it to the same nonlinear double stochastic model of return in financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Using Proportional Representation Methods as Alternatives to Pro-Rata Based Order Matching Algorithms in Stock Exchanges

Palash Sarkar, Sanjay Bhattacherjee

| Title | Authors | Year | Actions |

|---|

Comments (0)