Summary

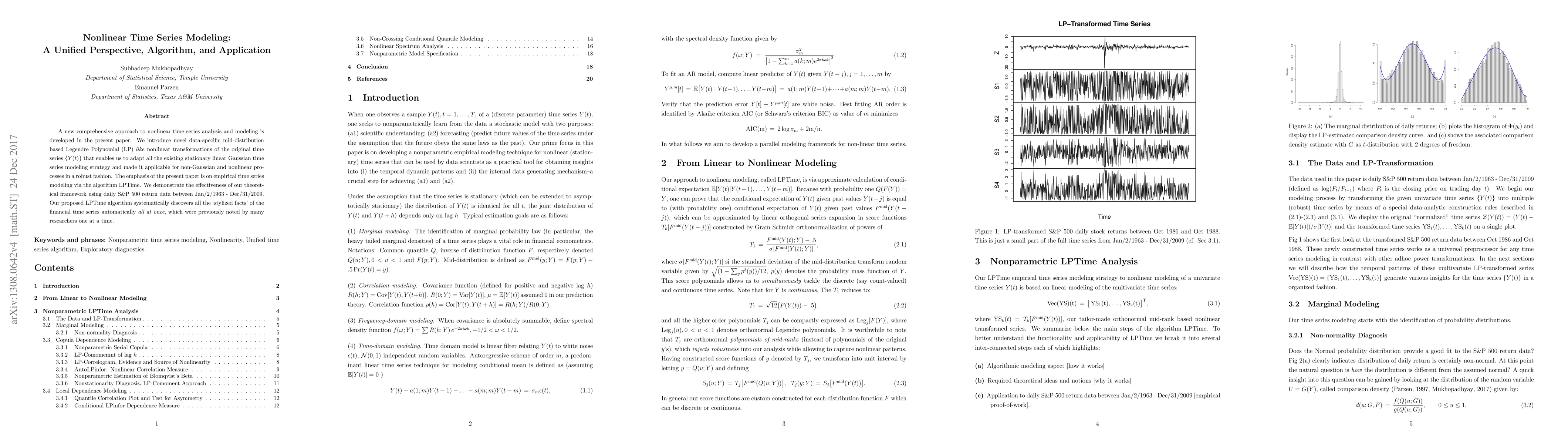

A new comprehensive approach to nonlinear time series analysis and modeling is developed in the present paper. We introduce novel data-specific mid-distribution based Legendre Polynomial (LP) like nonlinear transformations of the original time series Y(t) that enables us to adapt all the existing stationary linear Gaussian time series modeling strategy and made it applicable for non-Gaussian and nonlinear processes in a robust fashion. The emphasis of the present paper is on empirical time series modeling via the algorithm LPTime. We demonstrate the effectiveness of our theoretical framework using daily S&P 500 return data between Jan/2/1963 - Dec/31/2009. Our proposed LPTime algorithm systematically discovers all the `stylized facts' of the financial time series automatically all at once, which were previously noted by many researchers one at a time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Interpretable Nonlinear Modeling for Multiple Time Series

Baltasar Beferull-Lozano, Kevin Roy, Luis Miguel Lopez-Ramos

Time Series Generation Under Data Scarcity: A Unified Generative Modeling Approach

Ilan Naiman, Omri Azencot, Nimrod Berman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)