Authors

Summary

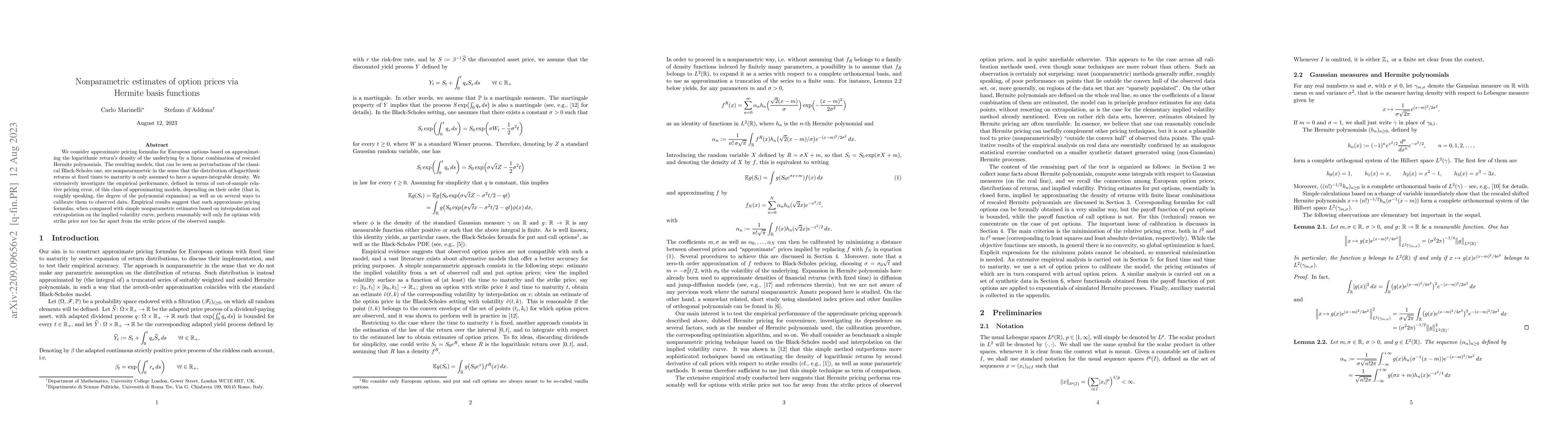

We consider approximate pricing formulas for European options based on approximating the logarithmic return's density of the underlying by a linear combination of rescaled Hermite polynomials. The resulting models, that can be seen as perturbations of the classical Black-Scholes one, are nonpararametric in the sense that the distribution of logarithmic returns at fixed times to maturity is only assumed to have a square-integrable density. We extensively investigate the empirical performance, defined in terms of out-of-sample relative pricing error, of this class of approximating models, depending on their order (that is, roughly speaking, the degree of the polynomial expansion) as well as on several ways to calibrate them to observed data. Empirical results suggest that such approximate pricing formulas, when compared with simple nonparametric estimates based on interpolation and extrapolation on the implied volatility curve, perform reasonably well only for options with strike price not too far apart from the strike prices of the observed sample.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the relative performance of some parametric and nonparametric estimators of option prices

Carlo Marinelli, Stefano D'Addona

| Title | Authors | Year | Actions |

|---|

Comments (0)