Authors

Summary

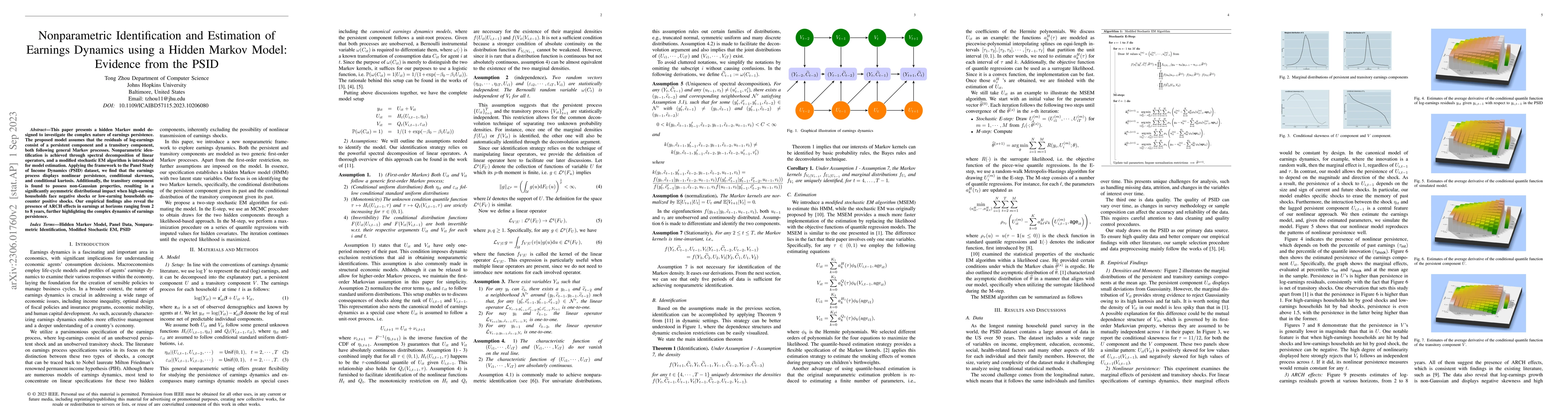

This paper presents a hidden Markov model designed to investigate the complex nature of earnings persistence. The proposed model assumes that the residuals of log-earnings consist of a persistent component and a transitory component, both following general Markov processes. Nonparametric identification is achieved through spectral decomposition of linear operators, and a modified stochastic EM algorithm is introduced for model estimation. Applying the framework to the Panel Study of Income Dynamics (PSID) dataset, we find that the earnings process displays nonlinear persistence, conditional skewness, and conditional kurtosis. Additionally, the transitory component is found to possess non-Gaussian properties, resulting in a significantly asymmetric distributional impact when high-earning households face negative shocks or low-earning households encounter positive shocks. Our empirical findings also reveal the presence of ARCH effects in earnings at horizons ranging from 2 to 8 years, further highlighting the complex dynamics of earnings persistence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)