Summary

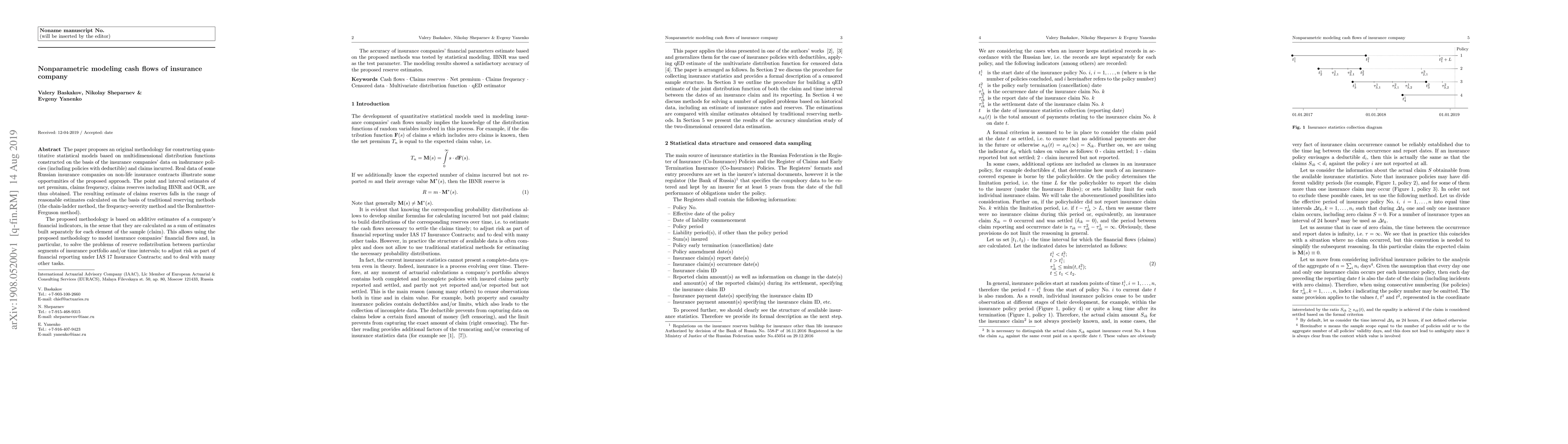

The paper proposes an original methodology for constructing quantitative statistical models based on multidimensional distribution functions constructed on the basis of the insurance companies' data on inshurance policies (including policies with deductible) and claims incurred. Real data of some Russian insurance companies on non-life insurance contracts illustrate some opportunities of the proposed approach. The point and interval estimates of net premium, claims frequency, claims reserves including IBNR and OCR, are thus obtained. The resulting estimate of claims reserves falls in the range of reasonable estimates calculated on the basis of traditional reserving methods (the chain-ladder method, the frequency-severity method and the Bornhuetter-Ferguson method). The proposed methodology is based on additive estimates of a company's financial indicators, in the sense that they are calculated as a sum of estimates built separately for each element of the sample (claim). This allows using the proposed methodology to model insurance companies' financial flows and, in particular, to solve the problems of reserve redistribution between particular segments of insurance portfolio and/or time intervals; to adjust risk as part of financial reporting under IAS 17 Insurance Contracts; and to deal with many other tasks. The accuracy of insurance companies' financial parameters estimate based on the proposed methods was tested by statistical modeling. IBNR was used as the test parameter. The modeling results showed a satisfactory accuracy of the proposed reserve estimates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Insurance Claims using Bayesian Nonparametric Regression

Kaushik Ghosh, Mostafa Shams Esfand Abadi

No citations found for this paper.

Comments (0)