Summary

Yule (1926) identified the issue of "nonsense correlations" in time series data, where dependence within each of two random vectors causes overdispersion -- i.e. variance inflation -- for measures of dependence between the two. During the near century since then, much has been written about nonsense correlations -- but nearly all of it confined to the time series literature. In this paper we provide the first, to our knowledge, rigorous study of this phenomenon for more general forms of (positive) dependence, specifically for Markov random fields on lattices and graphs. We consider both binary and continuous random vectors and three different measures of association: correlation, covariance, and the ordinary least squares coefficient that results from projecting one random vector onto the other. In some settings we find variance inflation consistent with Yule's nonsense correlation. However, surprisingly, we also find variance deflation in some settings, and in others the variance is unchanged under dependence. Perhaps most notably, we find general conditions under which OLS inference that ignores dependence is valid despite positive dependence in the regression errors, contradicting the presentation of OLS in countless textbooks and courses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

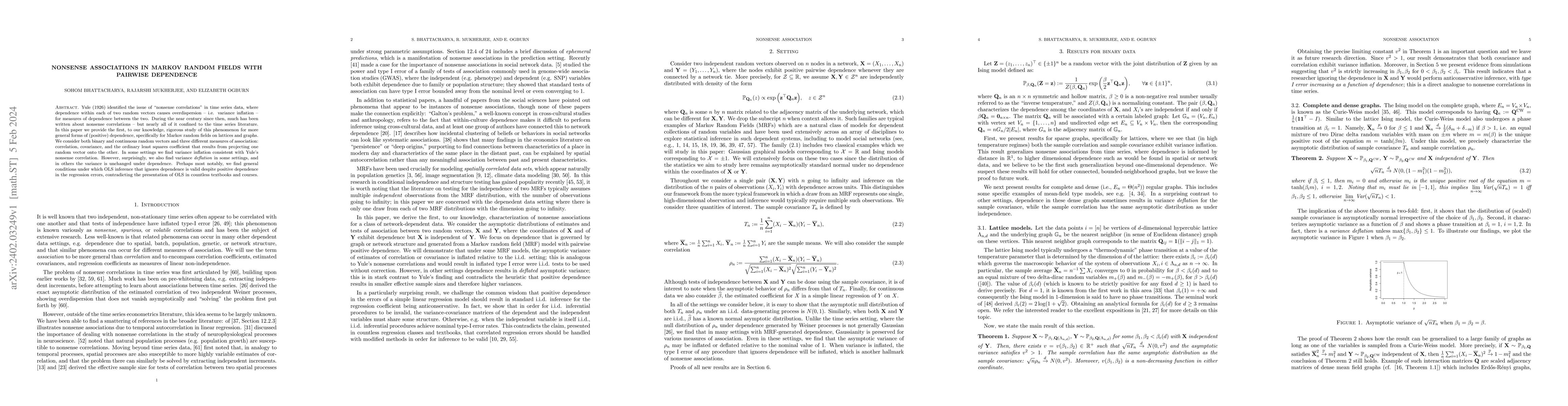

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Kullback-Leibler divergence between pairwise isotropic Gaussian-Markov random fields

Alexandre L. M. Levada

No citations found for this paper.

Comments (0)