Summary

Multinomial choice models are fundamental for empirical modeling of economic choices among discrete alternatives. We analyze identification of binary and multinomial choice models when the choice utilities are nonseparable in observed attributes and multidimensional unobserved heterogeneity with cross-section and panel data. We show that derivatives of choice probabilities with respect to continuous attributes are weighted averages of utility derivatives in cross-section models with exogenous heterogeneity. In the special case of random coefficient models with an independent additive effect, we further characterize that the probability derivative at zero is proportional to the population mean of the coefficients. We extend the identification results to models with endogenous heterogeneity using either a control function or panel data. In time stationary panel models with two periods, we find that differences over time of derivatives of choice probabilities identify utility derivatives "on the diagonal," i.e. when the observed attributes take the same values in the two periods. We also show that time stationarity does not identify structural derivatives "off the diagonal" both in continuous and multinomial choice panel models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

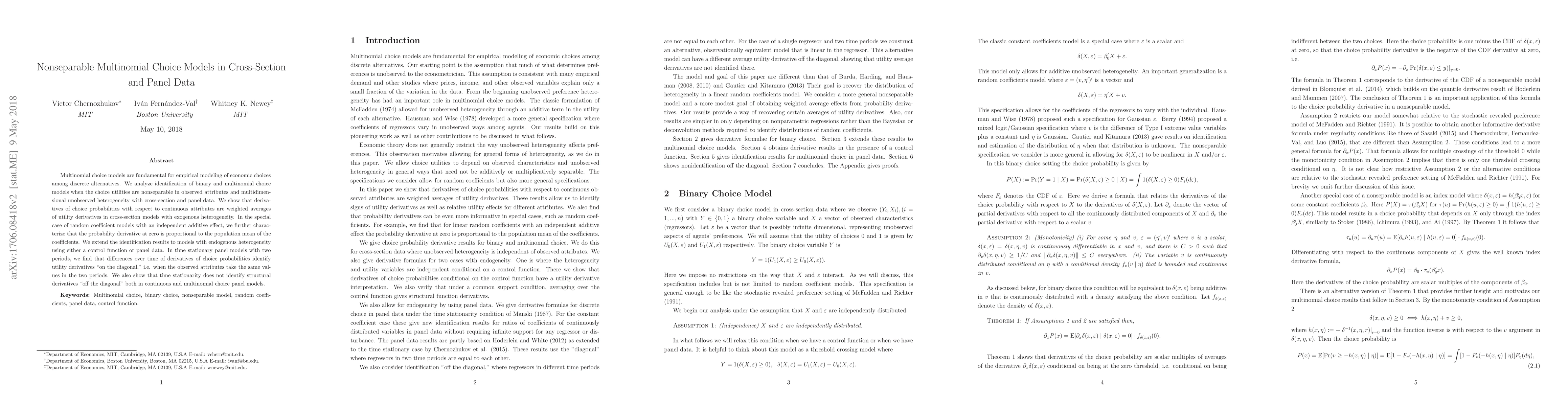

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)