Summary

We consider a general class of nonzero-sum $N$-player stochastic games with impulse controls, where players control the underlying dynamics with discrete interventions. We adopt a verification approach and provide sufficient conditions for the Nash equilibria (NEs) of the game. We then consider the limit situation of $N \to \infty$, that is, a suitable mean-field game (MFG) with impulse controls. We show that under appropriate technical conditions, the existence of unique NE solution to the MFG, which is an $\epsilon$-NE approximation to the $N$-player game, with $\epsilon=O\left(\frac{1}{\sqrt{N}}\right)$. As an example, we analyze in details a class of two-player stochastic games which extends the classical cash management problem to the game setting. In particular, we present numerical analysis for the cases of the single player, the two-player game, and the MFG, showing the impact of competition on the player's optimal strategy, with sensitivity analysis of the model parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

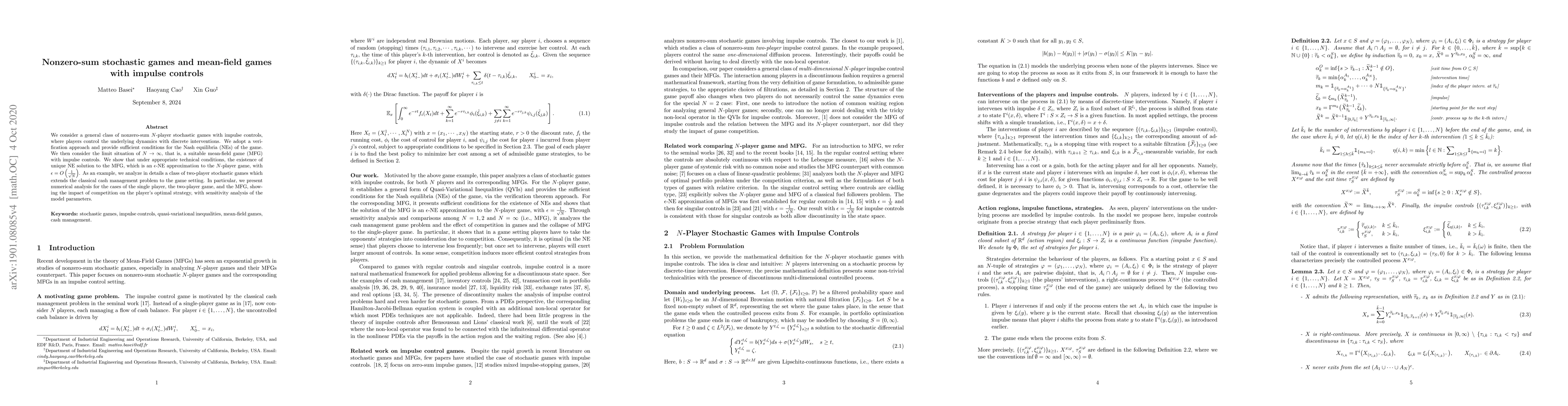

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)