Summary

In this article, normal inverse Gaussian (NIG) autoregressive model is introduced. The parameters of the model are estimated using Expectation Maximization (EM) algorithm. The efficacy of the EM algorithm is shown using simulated and real world financial data. It is shown that NIG autoregressive model fit very well the considered financial data and hence could be useful in modeling of various real life time-series data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

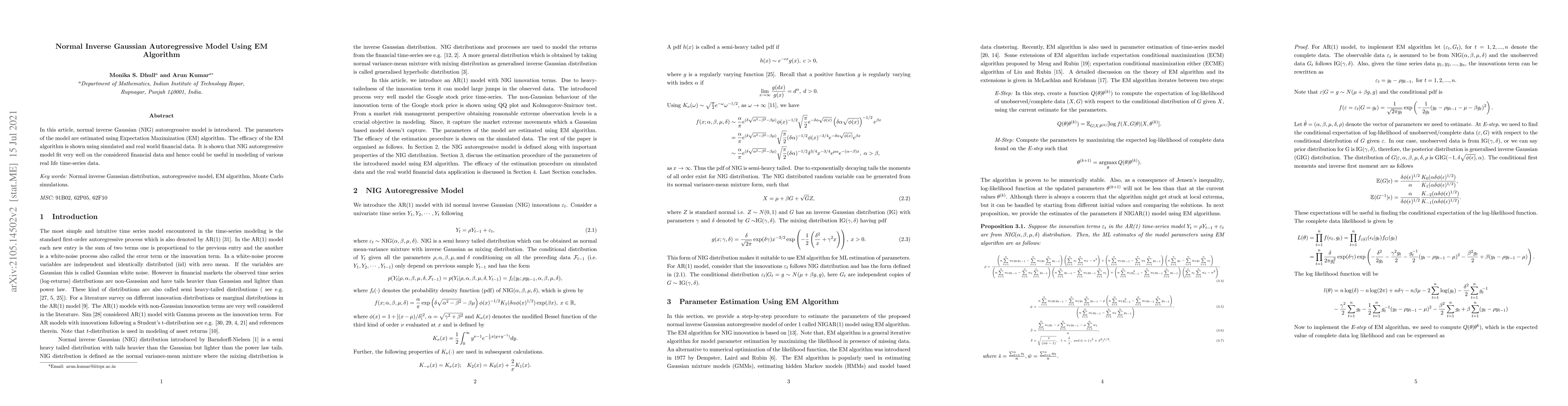

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNetwork EM Algorithm for Gaussian Mixture Model in Decentralized Federated Learning

Hansheng Wang, Xuetong Li, Shuyuan Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)