Summary

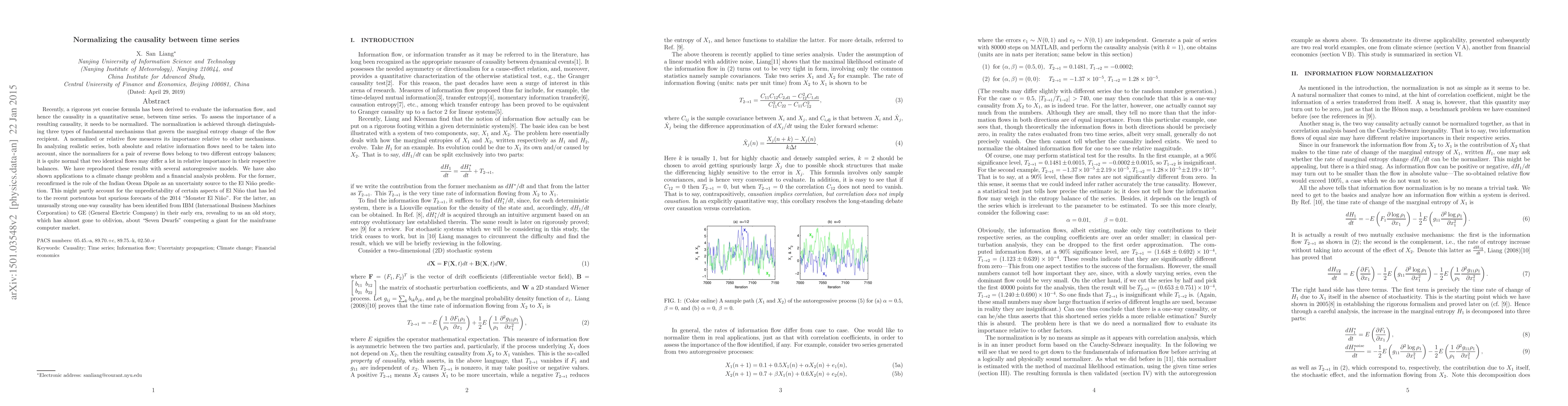

Recently, a rigorous yet concise formula has been derived to evaluate the information flow, and hence the causality in a quantitative sense, between time series. To assess the importance of a resulting causality, it needs to be normalized. The normalization is achieved through distinguishing three types of fundamental mechanisms that govern the marginal entropy change of the flow recipient. A normalized or relative flow measures its importance relative to other mechanisms. In analyzing realistic series, both absolute and relative information flows need to be taken into account, since the normalizers for a pair of reverse flows belong to two different entropy balances; it is quite normal that two identical flows may differ a lot in relative importance in their respective balances. We have reproduced these results with several autoregressive models. We have also shown applications to a climate change problem and a financial analysis problem. For the former, reconfirmed is the role of the Indian Ocean Dipole as an uncertainty source to the El Ni\~no prediction. This might partly account for the unpredictability of certain aspects of El Ni\~no that has led to the recent portentous but spurious forecasts of the 2014 "Monster El Ni\~no". For the latter, an unusually strong one-way causality has been identified from IBM (International Business Machines Corporation) to GE (General Electric Company) in their early era, revealing to us an old story, which has almost gone to oblivion, about "Seven Dwarfs" competing a giant for the mainframe computer market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)