Authors

Summary

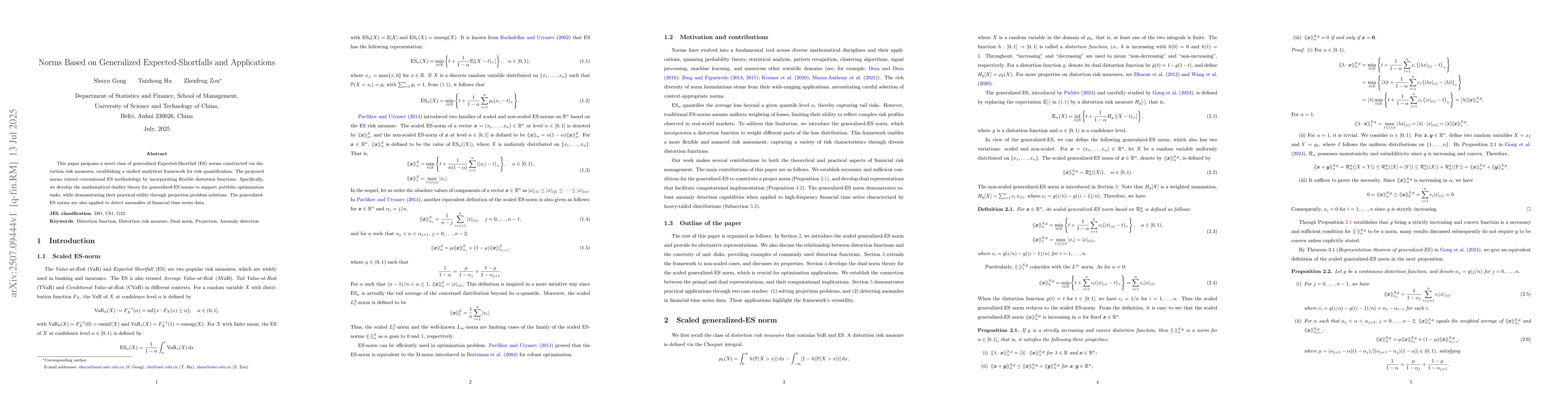

This paper proposes a novel class of generalized Expected-Shortfall (ES) norms constructed via distortion risk measures, establishing a unified analytical framework for risk quantification. The proposed norms extend conventional ES methodology by incorporating flexible distortion functions. Specifically, we develop the mathematical duality theory for generalized-ES norms to support portfolio optimization tasks, while demonstrating their practical utility through projection problem solutions. The generalizedES norms are also applied to detect anomalies of financial time series data.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Similar Papers

Found 4 papersMonge-Kantorovich superquantiles and expected shortfalls with applications to multivariate risk measurements

Bernard Bercu, Gauthier Thurin, Jeremie Bigot

Probability equivalent level of Value at Risk and higher-order Expected Shortfalls

Matyas Barczy, Fanni K. Nedényi, László Sütő

Orthant-Strictly Monotonic Norms, Generalized Top-k and k-Support Norms and the L0 Pseudonorm

Jean-Philippe Chancelier, Michel de Lara

Comments (0)