Summary

The Levy-Levy-Solomon model (A microscopic model of the stock market: cycles, booms, and crashes, Economic Letters 45 (1))is one of the most influential agent-based economic market models. In several publications this model has been discussed and analyzed. Especially Lux and Zschischang (Some new results on the Levy, Levy and Solomon microscopic stock market model, Physica A, 291(1-4)) have shown that the model exhibits finite-size effects. In this study we extend existing work in several directions. First, we show simulations which reveal finite-size effects of the model. Secondly, we shed light on the origin of these finite-size effects. Furthermore, we demonstrate the sensitivity of the Levy-Levy-Solomon model with respect to random numbers. Especially, we can conclude that a low-quality pseudo random number generator has a huge impact on the simulation results. Finally, we study the impact of the stopping criteria in the market clearance mechanism of the Levy-Levy-Solomon model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

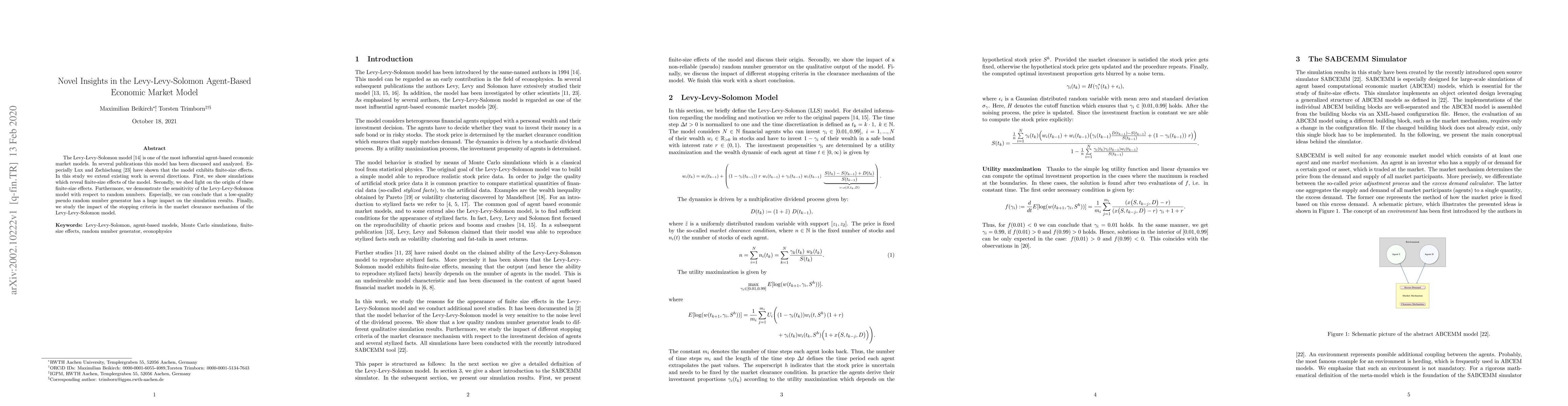

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)