Authors

Summary

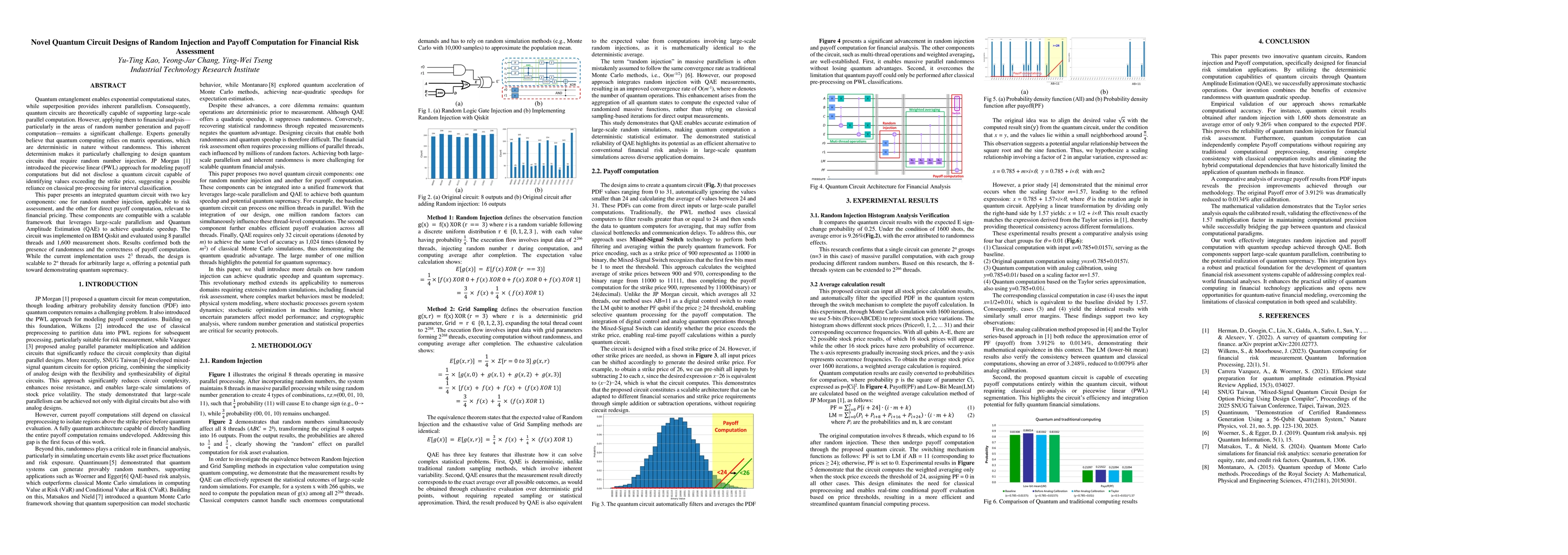

Quantum entanglement enables exponential computational states, while superposition provides inherent parallelism. Consequently, quantum circuits are theoretically capable of supporting large scale parallel computation. However, applying them to financial analysis particularly in the areas of random number generation and payoff computation remains a significant challenge. Experts generally believe that quantum computing relies on matrix operations, which are deterministic in nature without randomness. This inherent determinism makes it particularly challenging to design quantum circuits that require random number injection. JP Morgan[1] introduced the piecewise linear (PWL) approach for modeling payoff computations but did not disclose a quantum circuit capable of identifying values exceeding the strike price, suggesting a possible reliance on classical pre processing for interval classification. This paper presents an integrated quantum circuit with two key components: one for random number injection, applicable to risk assessment, and the other for direct payoff computation, relevant to financial pricing. These components are compatible with a scalable framework that leverages large scale parallelism and Quantum Amplitude Estimation (QAE) to achieve quadratic speedup. The circuit was implemented on IBM Qiskit and evaluated using 8 parallel threads and 1600 measurement shots. Results confirmed both the presence of randomness and the correctness of payoff computation. While the current implementation uses 8 threads, the design scales to 2 to the power of n threads, for arbitrarily large n, offering a potential path toward demonstrating quantum supremacy.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes two novel quantum circuit components: one for random number injection and another for payoff computation. These components are integrated into a unified framework leveraging large-scale parallelism and Quantum Amplitude Estimation (QAE) for quantum speedup and potential quantum supremacy.

Key Results

- The quantum circuit can process one million threads in parallel, with one million random factors influencing thread-level computations.

- QAE demonstrates a quantum quadratic advantage, requiring only 32 circuit operations to achieve the same level of accuracy as 1,024 classical Monte Carlo simulations.

- The proposed methodology shows a single circuit can generate 2^n groups of massive parallel computation, with each group producing different random numbers.

Significance

This research is significant as it addresses the challenge of combining large-scale parallelism and inherent randomness for scalable quantum financial analysis, potentially revolutionizing financial risk assessment and other domains requiring extensive random simulations.

Technical Contribution

The paper presents an integrated quantum circuit with components for random number injection and direct payoff computation, compatible with a scalable framework that leverages large-scale parallelism and Quantum Amplitude Estimation (QAE) for quadratic speedup.

Novelty

The novelty of this work lies in its integrated approach to both random number injection and payoff computation within a single quantum circuit, addressing the challenge of combining randomness and quantum speedup for financial risk assessment.

Limitations

- The current implementation uses 8 threads, though the design scales to 2^n threads.

- The paper does not discuss the practical hardware limitations for scaling up to very large numbers of threads.

Future Work

- Explore the scalability of the proposed design to even larger numbers of threads.

- Investigate the impact of noise and error correction mechanisms on the circuit's performance as the number of threads increases.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)