Summary

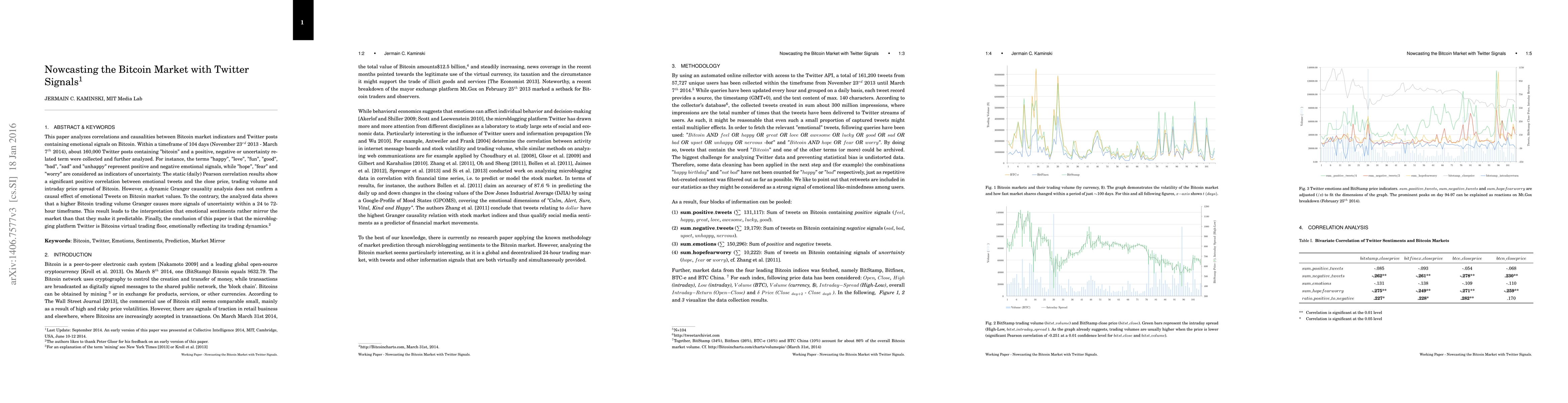

This paper analyzes correlations and causalities between Bitcoin market indicators and Twitter posts containing emotional signals on Bitcoin. Within a timeframe of 104 days (November 23rd 2013 - March 7th 2014), about 160,000 Twitter posts containing "bitcoin" and a positive, negative or uncertainty related term were collected and further analyzed. For instance, the terms "happy", "love", "fun", "good", "bad", "sad" and "unhappy" represent positive and negative emotional signals, while "hope", "fear" and "worry" are considered as indicators of uncertainty. The static (daily) Pearson correlation results show a significant positive correlation between emotional tweets and the close price, trading volume and intraday price spread of Bitcoin. However, a dynamic Granger causality analysis does not confirm a statistically significant effect of emotional Tweets on Bitcoin market values. To the contrary, the analyzed data shows that a higher Bitcoin trading volume Granger causes more signals of uncertainty within a 24 to 72-hour timeframe. This result leads to the interpretation that emotional sentiments rather mirror the market than that they make it predictable. Finally, the conclusion of this paper is that the microblogging platform Twitter is Bitcoin's virtual trading floor, emotionally reflecting its trading dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)