Authors

Summary

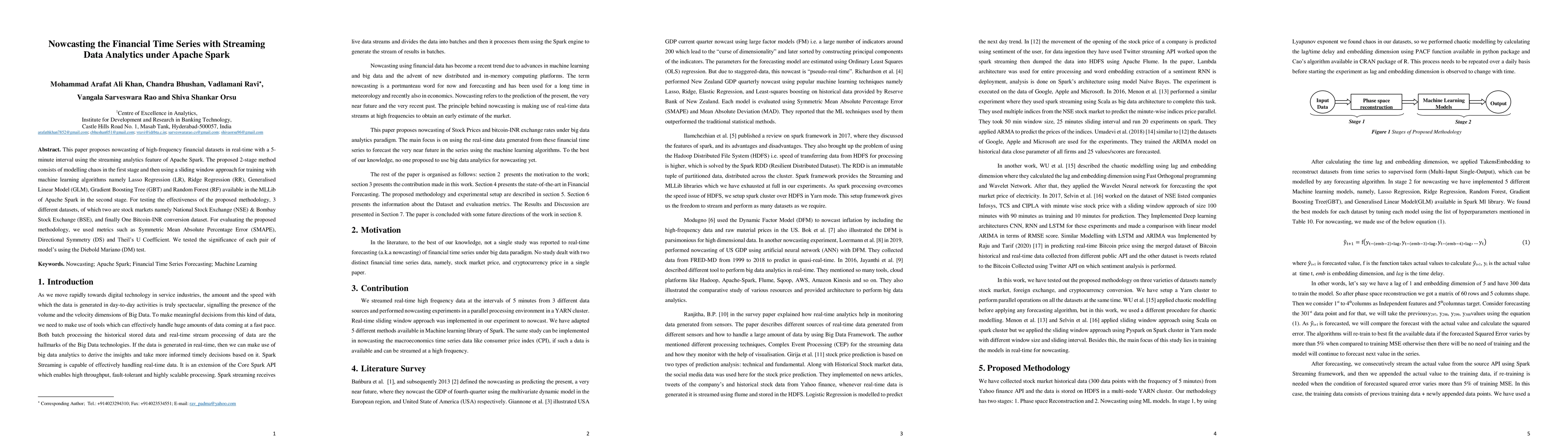

This paper proposes nowcasting of high-frequency financial datasets in real-time with a 5-minute interval using the streaming analytics feature of Apache Spark. The proposed 2 stage method consists of modelling chaos in the first stage and then using a sliding window approach for training with machine learning algorithms namely Lasso Regression, Ridge Regression, Generalised Linear Model, Gradient Boosting Tree and Random Forest available in the MLLib of Apache Spark in the second stage. For testing the effectiveness of the proposed methodology, 3 different datasets, of which two are stock markets namely National Stock Exchange & Bombay Stock Exchange, and finally One Bitcoin-INR conversion dataset. For evaluating the proposed methodology, we used metrics such as Symmetric Mean Absolute Percentage Error, Directional Symmetry, and Theil U Coefficient. We tested the significance of each pair of models using the Diebold Mariano (DM) test.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)