Authors

Summary

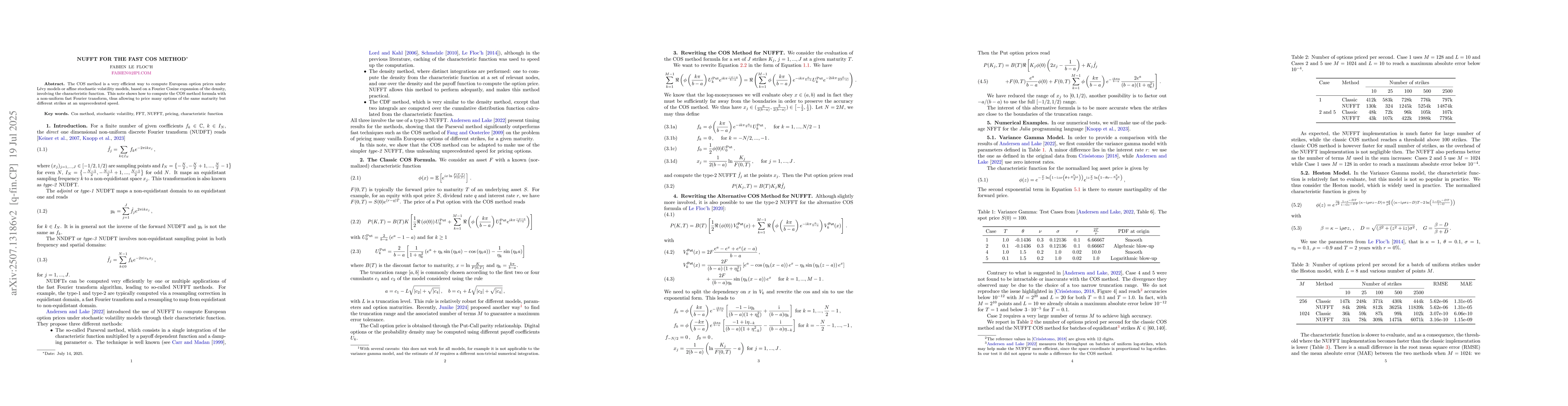

The COS method is a very efficient way to compute European option prices under L\'evy models or affine stochastic volatility models, based on a Fourier Cosine expansion of the density, involving the characteristic function. This note shows how to compute the COS method formula with a non-uniform fast Fourier transform, thus allowing to price many options of the same maturity but different strikes at an unprecedented speed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFast Barrier Option Pricing by the COS BEM Method in Heston Model

A. Aimi, C. Guardasoni, L. Ortiz-Gracia et al.

Efficient approximation of Jacobian matrices involving a non-uniform fast Fourier transform (NUFFT)

Guanhua Wang, Jeffrey A. Fessler

Precise option pricing by the COS method--How to choose the truncation range

Konstantin Pankrashkin, Gero Junike

No citations found for this paper.

Comments (0)