Summary

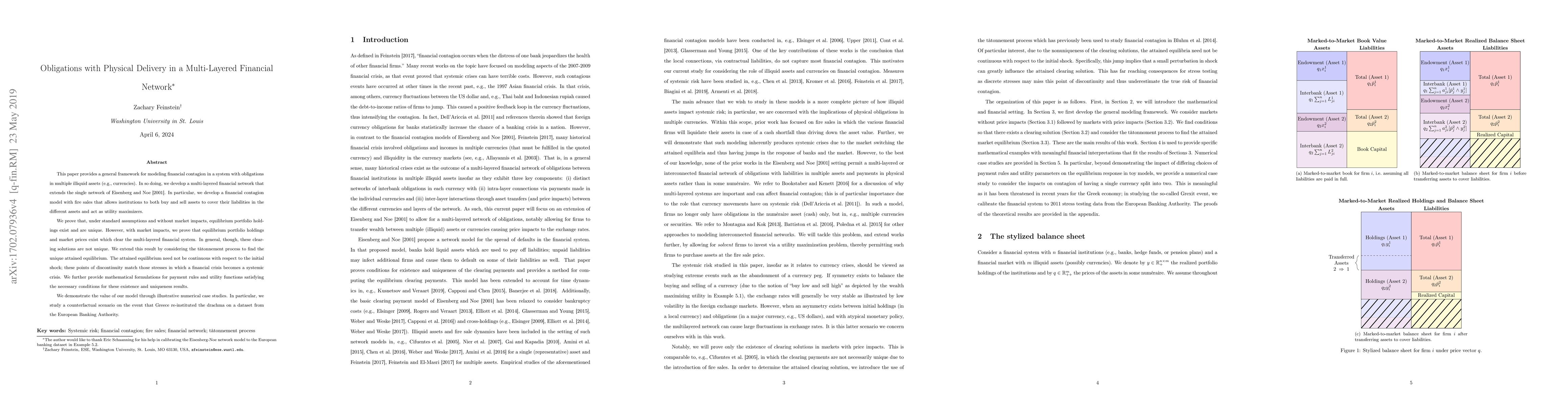

This paper provides a general framework for modeling financial contagion in a system with obligations in multiple illiquid assets (e.g., currencies). In so doing, we develop a multi-layered financial network that extends the single network of Eisenberg and Noe (2001). In particular, we develop a financial contagion model with fire sales that allows institutions to both buy and sell assets to cover their liabilities in the different assets and act as utility maximizers. We prove that, under standard assumptions and without market impacts, equilibrium portfolio holdings exist and are unique. However, with market impacts, we prove that equilibrium portfolio holdings and market prices exist which clear the multi-layered financial system. In general, though, these clearing solutions are not unique. We extend this result by considering the t\^atonnement process to find the unique attained equilibrium. The attained equilibrium need not be continuous with respect to the initial shock; these points of discontinuity match those stresses in which a financial crisis becomes a systemic crisis. We further provide mathematical formulations for payment rules and utility functions satisfying the necessary conditions for these existence and uniqueness results. We demonstrate the value of our model through illustrative numerical case studies. In particular, we study a counterfactual scenario on the event that Greece re-instituted the drachma on a dataset from the European Banking Authority.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)