Authors

Summary

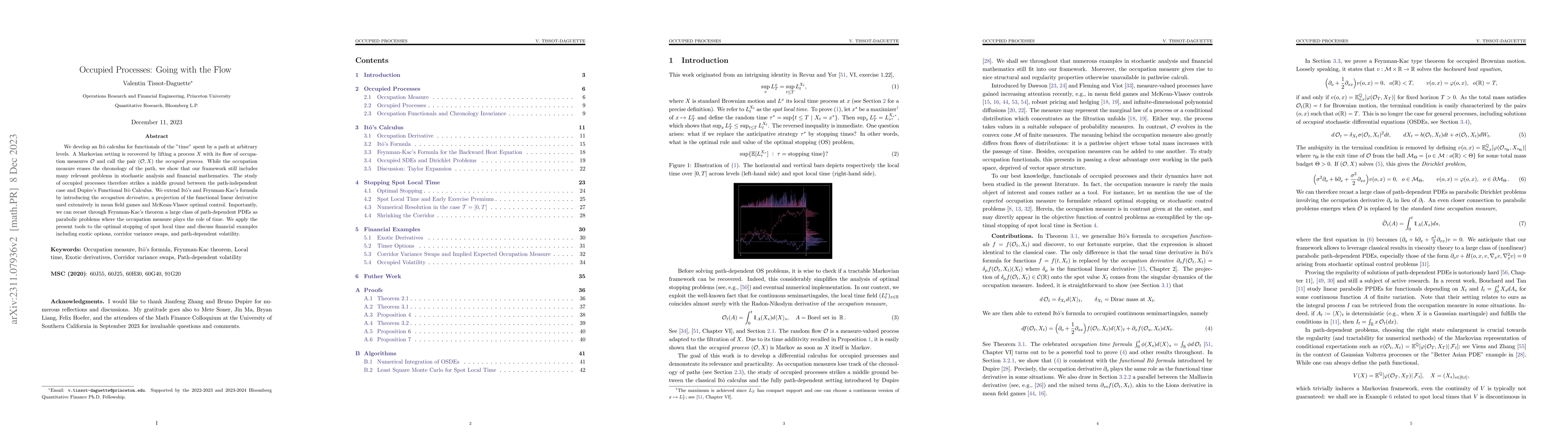

We develop an It\^o calculus for functionals of the "time" spent by a path at arbitrary levels. A Markovian setting is recovered by lifting a process $X$ with its flow of occupation measures $\mathcal{O}$ and call the pair $(\mathcal{O},X)$ the occupied process. While the occupation measure erases the chronology of the path, we show that our framework still includes many relevant problems in stochastic analysis and financial mathematics. The study of occupied processes therefore strikes a middle ground between the path-independent case and Dupire's Functional It\^o Calculus. We extend It\^o's and Feynman-Kac's formula by introducing the occupation derivative, a projection of the functional linear derivative used extensively in mean field games and McKean-Vlasov optimal control. Importantly, we can recast through Feynman-Kac's theorem a large class of path-dependent PDEs as parabolic problems where the occupation measure plays the role of time. We apply the present tools to the optimal stopping of spot local time and discuss financial examples including exotic options, corridor variance swaps, and path-dependent volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersControlled Occupied Processes and Viscosity Solutions

Jianfeng Zhang, H. Mete Soner, Valentin Tissot-Daguette

| Title | Authors | Year | Actions |

|---|

Comments (0)