Summary

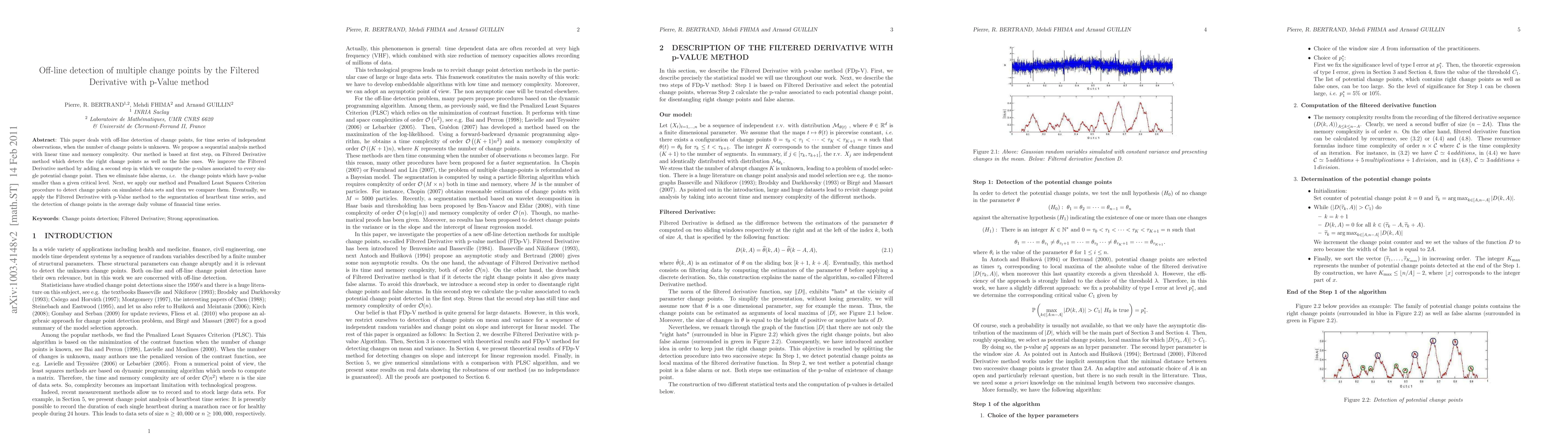

This paper deals with off-line detection of change points for time series of independent observations, when the number of change points is unknown. We propose a sequential analysis like method with linear time and memory complexity. Our method is based at first step, on Filtered Derivative method which detects the right change points but also false ones. We improve Filtered Derivative method by adding a second step in which we compute the p-values associated to each potential change points. Then we eliminate as false alarms the points which have p-value smaller than a given critical level. Next, our method is compared with the Penalized Least Square Criterion procedure on simulated data sets. Eventually, we apply Filtered Derivative with p-Value method to segmentation of heartbeat time series, and detection of change points in the average daily volume of financial time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-segmental Bayesian Detection of Multiple Change-points

Xu Zhang, Chong Zhong, Catherine C. Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)