Authors

Summary

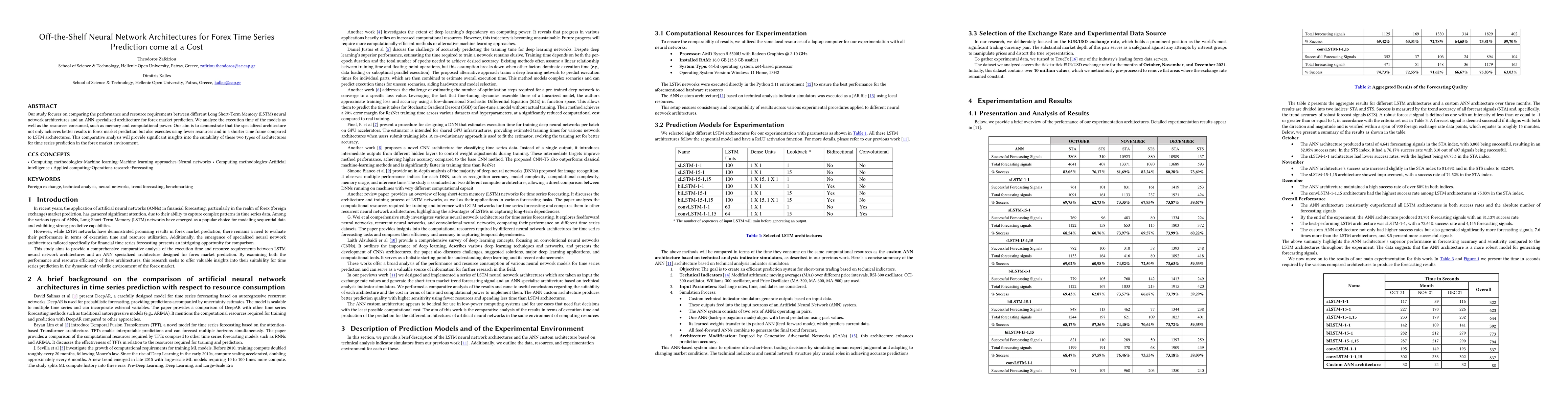

Our study focuses on comparing the performance and resource requirements between different Long Short-Term Memory (LSTM) neural network architectures and an ANN specialized architecture for forex market prediction. We analyze the execution time of the models as well as the resources consumed, such as memory and computational power. Our aim is to demonstrate that the specialized architecture not only achieves better results in forex market prediction but also executes using fewer resources and in a shorter time frame compared to LSTM architectures. This comparative analysis will provide significant insights into the suitability of these two types of architectures for time series prediction in the forex market environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative analysis of neural network architectures for short-term FOREX forecasting

Dimitris Kalles, Theodoros Zafeiriou

No citations found for this paper.

Comments (0)