Authors

Summary

We introduce a method for pricing consumer credit using recent advances in offline deep reinforcement learning. This approach relies on a static dataset and requires no assumptions on the functional form of demand. Using both real and synthetic data on consumer credit applications, we demonstrate that our approach using the conservative Q-Learning algorithm is capable of learning an effective personalized pricing policy without any online interaction or price experimentation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

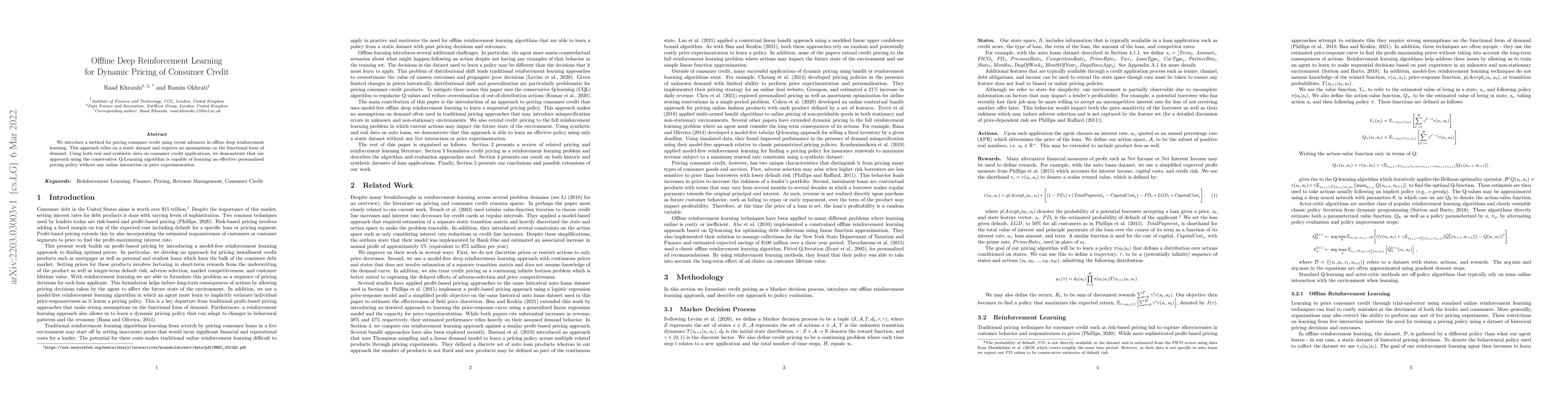

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic network congestion pricing based on deep reinforcement learning

Toru Seo, Kimihiro Sato, Takashi Fuse

MACCA: Offline Multi-agent Reinforcement Learning with Causal Credit Assignment

Biwei Huang, Ziyan Wang, Meng Fang et al.

Algorithmic Collusion in Dynamic Pricing with Deep Reinforcement Learning

Martin Bichler, Shidi Deng, Maximilian Schiffer

Dual-Agent Deep Reinforcement Learning for Dynamic Pricing and Replenishment

Yi Zheng, Peng Jiang, Yijie Peng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)