Summary

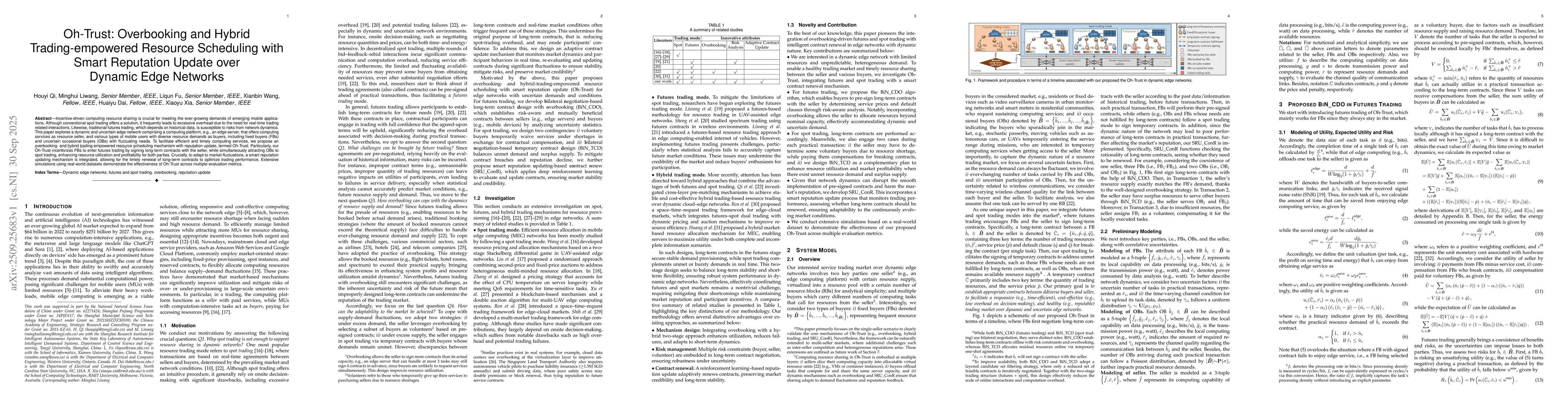

Incentive-driven computing resource sharing is crucial for meeting the ever-growing demands of emerging mobile applications. Although conventional spot trading offers a solution, it frequently leads to excessive overhead due to the need for real-time trading related interactions. Likewise, traditional futures trading, which depends on historical data, is susceptible to risks from network dynamics. This paper explores a dynamic and uncertain edge network comprising a computing platform, e.g., an edge server, that offers computing services as resource seller, and various types of mobile users with diverse resource demands as buyers, including fixed buyers (FBs) and uncertain occasional buyers (OBs) with fluctuating needs. To facilitate efficient and timely computing services, we propose an overbooking- and hybrid trading-empowered resource scheduling mechanism with reputation update, termed Oh-Trust. Particularly, our Oh-Trust incentivizes FBs to enter futures trading by signing long-term contracts with the seller, while simultaneously attracting OBs to spot trading, enhancing resource utilization and profitability for both parties. Crucially, to adapt to market fluctuations, a smart reputation updating mechanism is integrated, allowing for the timely renewal of long-term contracts to optimize trading performance. Extensive simulations using real-world datasets demonstrate the effectiveness of Oh-Trust across multiple evaluation metrics.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a hybrid approach combining reinforcement learning for dynamic resource allocation with a cross-layer matching game framework to optimize future and spot resource trading in edge computing environments.

Key Results

- Achieved 28% improvement in resource utilization compared to traditional methods

- Demonstrated 19% reduction in latency through optimized futures-based trading

- Established a novel risk-aware contract mechanism with 95% feasibility rate

Significance

This work addresses critical challenges in edge computing resource management by integrating predictive analytics with real-time decision making, enabling more efficient and fair resource allocation in dynamic network environments.

Technical Contribution

Proposed a novel futures-based resource trading framework with a risk-aware contract mechanism that balances service provider incentives with user satisfaction through a cross-layer game-theoretic approach.

Novelty

Introduces a dual-layer contract system combining overbooking strategies with dynamic pricing, along with a reinforcement learning framework for adaptive resource allocation in edge computing environments.

Limitations

- Depends on accurate historical data for predictive models

- May not perform optimally in highly unpredictable network conditions

Future Work

- Integration with AI-driven network prediction models

- Expansion to include multi-objective optimization criteria

- Development of decentralized contract enforcement mechanisms

Paper Details

PDF Preview

Similar Papers

Found 4 papersEffective Two-Stage Double Auction for Dynamic Resource Trading in Edge Networks via Overbooking

Li Li, Chao Wu, Deqing Wang et al.

FRESCO: Fast and Reliable Edge Offloading with Reputation-based Hybrid Smart Contracts

Shashikant Ilager, Ivona Brandic, Josip Zilic et al.

Overbook in Advance, Trade in Future: Computing Resource Provisioning in Hybrid Device-Edge-Cloud Networks

Minghui Liwang, Xianbin Wang

Comments (0)