Summary

Consistently fitting vanilla option surfaces is an important issue when it comes to modelling in finance. Local volatility models introduced by Dupire in 1994 are widely used to price and manage the risks of structured products. However, the inconsistencies observed between the dynamics of the smile in those models and in real markets motivate researches for stochastic volatility modelling. Combining both those ideas to form Local and Stochastic Volatility models is of interest for practitioners. In this paper, we study the calibration of the vanillas in those models. This problem can be written as a nonlinear and nonlocal partial differential equation, for which we prove short-time existence of solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

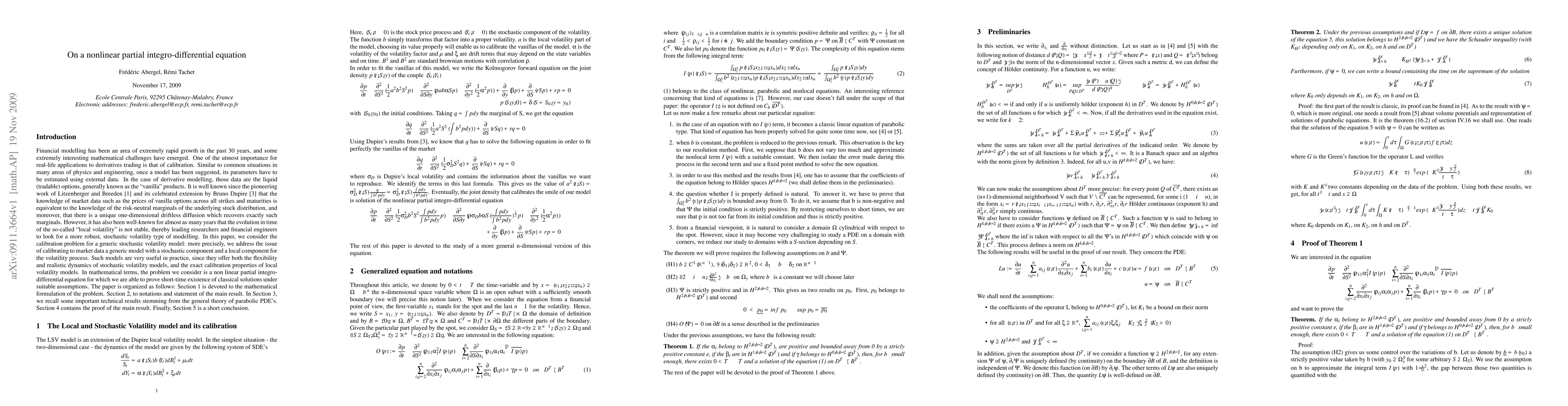

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)