Summary

In this paper we study a representation problem first considered in a simpler version by Bank and El Karoui [2004]. A key ingredient to this problem is a random measure $\mu$ on the time axis which in the present paper is allowed to have atoms. Such atoms turn out to not only pose serious technical challenges in the proof of the representation theorem, but actually have significant meaning in its applications, for instance, in irreversible investment problems. These applications also suggest to study the problem for processes which are measurable with respect to a Meyer-$\sigma$-field that lies between the predictable and the optional $\sigma$-field. Technically, our proof amounts to a delicate analysis of optimal stopping problems and the corresponding optimal divided stopping times and we will show in a second application how an optimal stopping problem over divided stopping times can conversely be obtained from the solution of the representation problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

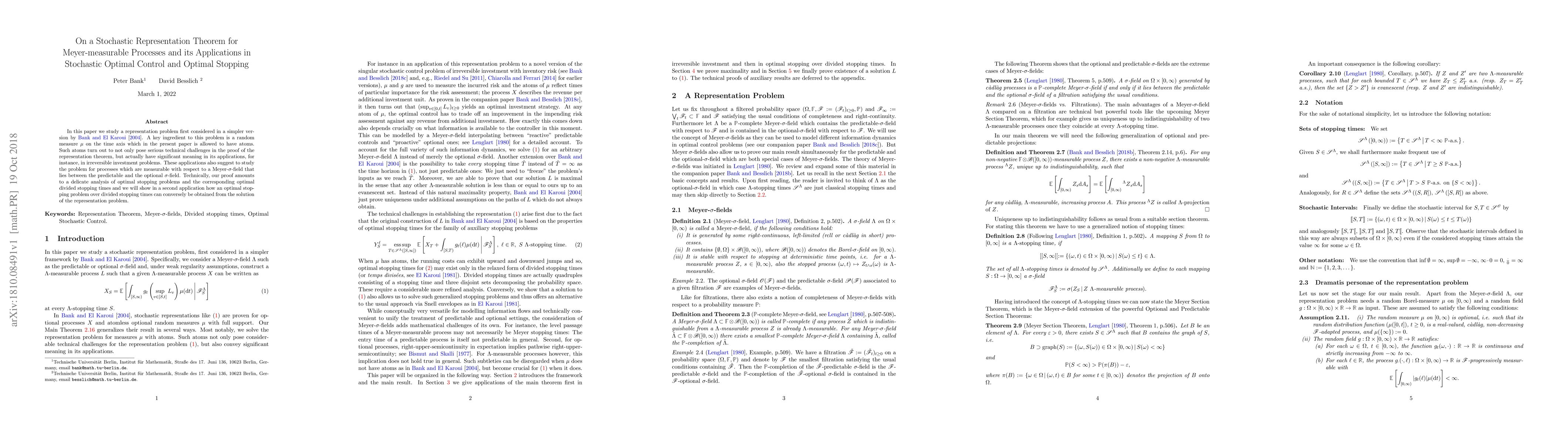

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)