Summary

The existence of optimal strategy in robust utility maximization is addressed when the utility function is finite on the entire real line. A delicate problem in this case is to find a "good definition" of admissible strategies, so that an optimizer is obtained. Under suitable assumptions, especially a time-consistency property of the set of probabilities which describes the model uncertainty, we show that an optimal strategy is obtained in the class of strategies whose wealths are supermartingales under all local martingale measures having a finite generalized entropy with at least one of candidate models (probabilities).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

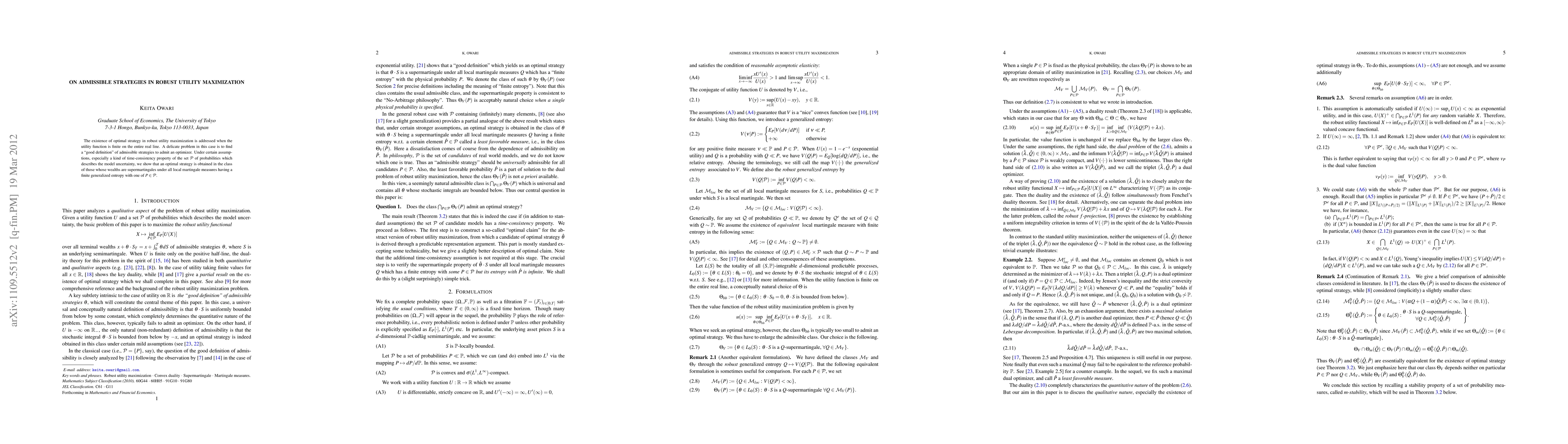

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust utility maximization with intractable claims

Xun Yu Zhou, Zuo Quan Xu, Yunhong Li

Robust utility maximization with nonlinear continuous semimartingales

David Criens, Lars Niemann

| Title | Authors | Year | Actions |

|---|

Comments (0)