Summary

In the context of a general continuous financial market model, we study whether the additional information associated with an honest time gives rise to arbitrage profits. By relying on the theory of progressive enlargement of filtrations, we explicitly show that no kind of arbitrage profit can ever be realised strictly before an honest time, while classical arbitrage opportunities can be realised exactly at an honest time as well as after an honest time. Moreover, stronger arbitrages of the first kind can only be obtained by trading as soon as an honest time occurs. We carefully study the behavior of local martingale deflators and consider no-arbitrage-type conditions weaker than NFLVR.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

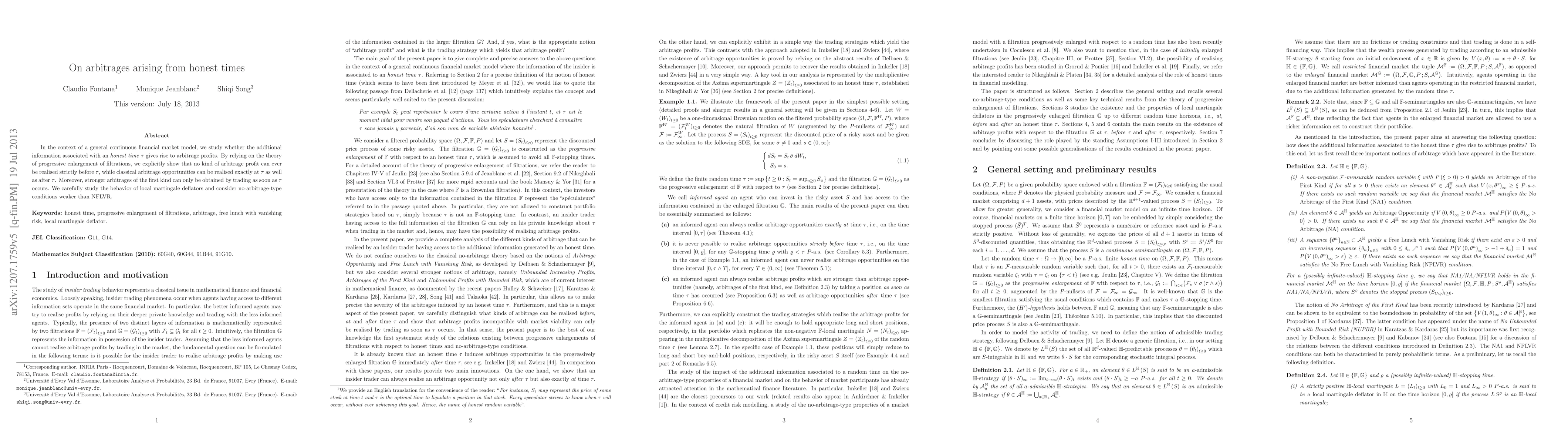

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)