Summary

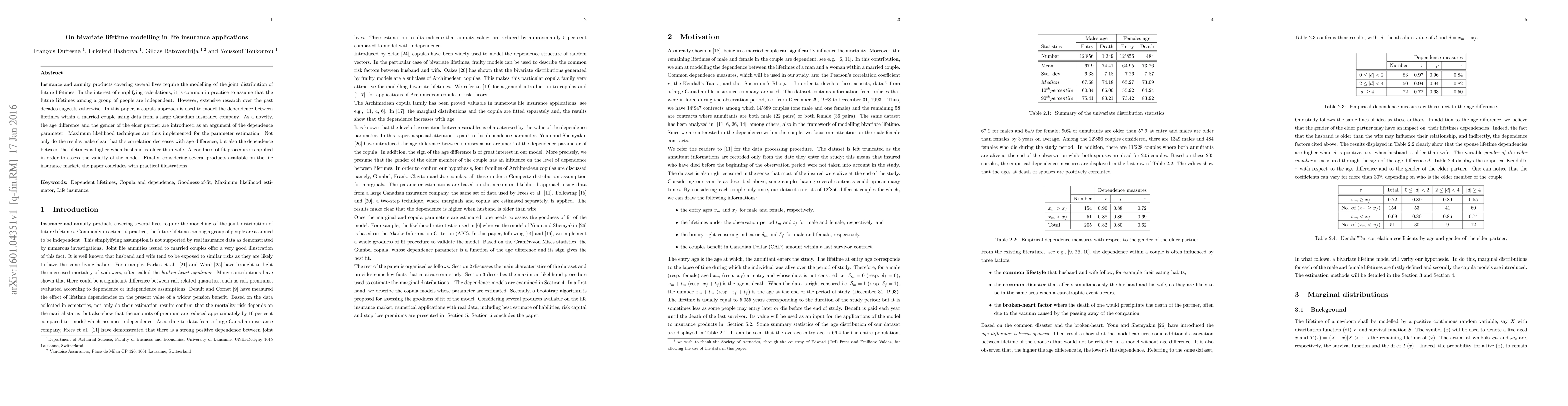

Insurance and annuity products covering several lives require the modelling of the joint distribution of future lifetimes. In the interest of simplifying calculations, it is common in practice to assume that the future lifetimes among a group of people are independent. However, extensive research over the past decades suggests otherwise. In this paper, a copula approach is used to model the dependence between lifetimes within a married couple \eH{using data from a large Canadian insurance company}. As a novelty, the age difference and the \eH{gender} of the elder partner are introduced as an argument of the dependence parameter. \green{Maximum likelihood techniques are} thus implemented for the parameter estimation. Not only do the results make clear that the correlation decreases with age difference, but also the dependence between the lifetimes is higher when husband is older than wife. A goodness-of-fit procedure is applied in order to assess the validity of the model. Finally, considering several products available on the life insurance market, the paper concludes with practical illustrations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)