Summary

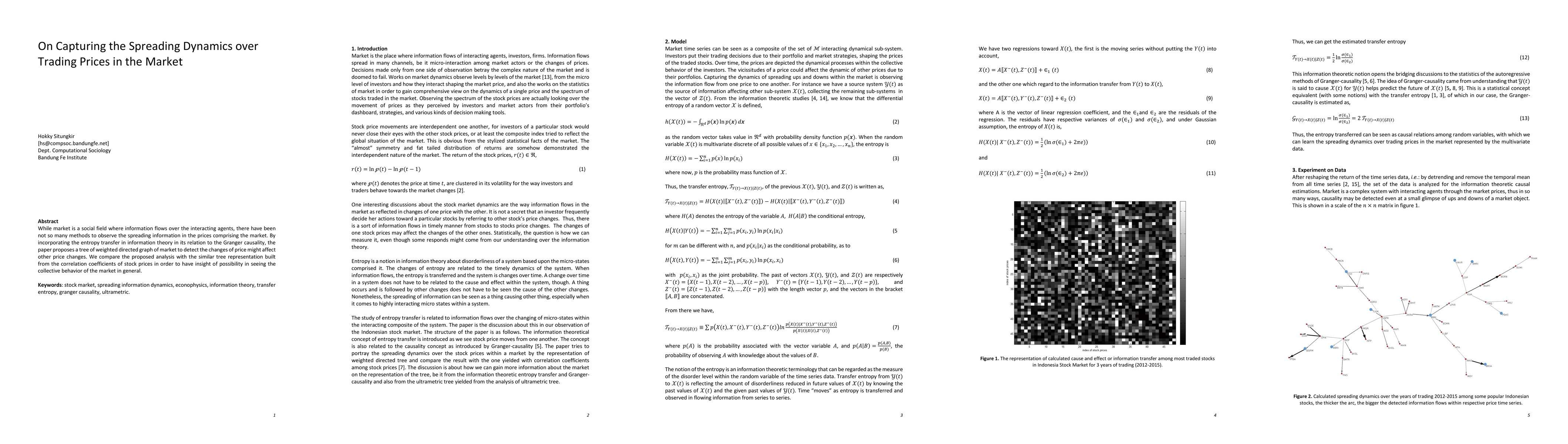

While market is a social field where information flows over the interacting agents, there have been not so many methods to observe the spreading information in the prices comprising the market. By incorporating the entropy transfer in information theory in its relation to the Granger causality, the paper proposes a tree of weighted directed graph of market to detect the changes of price might affect other price changes. We compare the proposed analysis with the similar tree representation built from the correlation coefficients of stock prices in order to have insight of possibility in seeing the collective behavior of the market in general.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)