Summary

Multi stage stochastic programs arise in many applications from engineering whenever a set of inventories or stocks has to be valued. Such is the case in seasonal storage valuation of a set of cascaded reservoir chains in hydro management. A popular method is Stochastic Dual Dynamic Programming (SDDP), especially when the dimensionality of the problem is large and Dynamic programming no longer an option. The usual assumption of SDDP is that uncertainty is stage-wise independent, which is highly restrictive from a practical viewpoint. When possible, the usual remedy is to increase the state-space to account for some degree of dependency. In applications this may not be possible or it may increase the state space by too much. In this paper we present an alternative based on keeping a functional dependency in the SDDP - cuts related to the conditional expectations in the dynamic programming equations. Our method is based on popular methodology in mathematical finance, where it has progressively replaced scenario trees due to superior numerical performance. On a set of numerical examples, we too show the interest of this way of handling dependency in uncertainty, when combined with SDDP. Our method is readily available in the open source software package StOpt.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

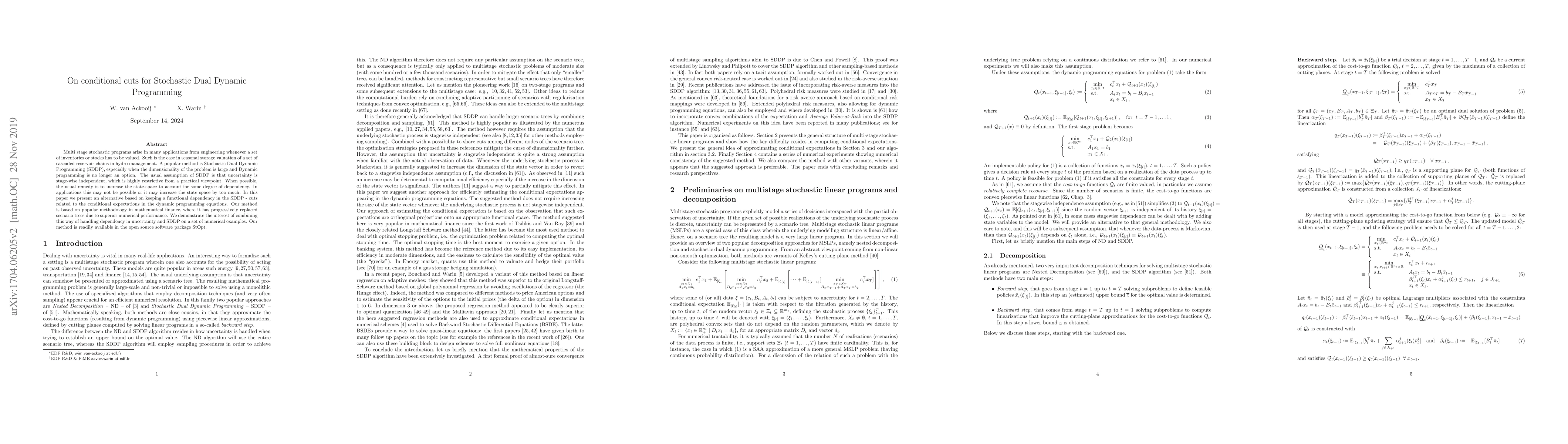

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)