Summary

We propose a dynamic model of a prediction market in which agents predict the values of a sequence of random vectors. The main result shows that if there are agents who make correct (or asymptotically correct) next-period forecasts, then the aggregated market forecasts converge to the next-period conditional expectations of the random vectors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

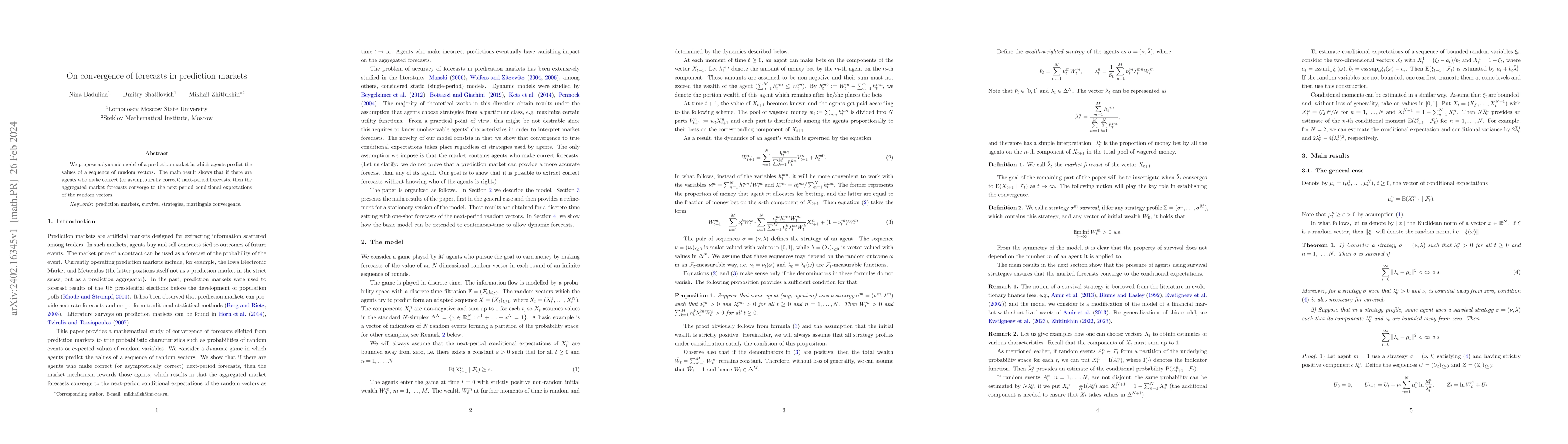

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Interpretability of Prediction Markets: A Convergence Analysis

Jianjun Gao, Zizhuo Wang, Dian Yu et al.

No citations found for this paper.

Comments (0)