Summary

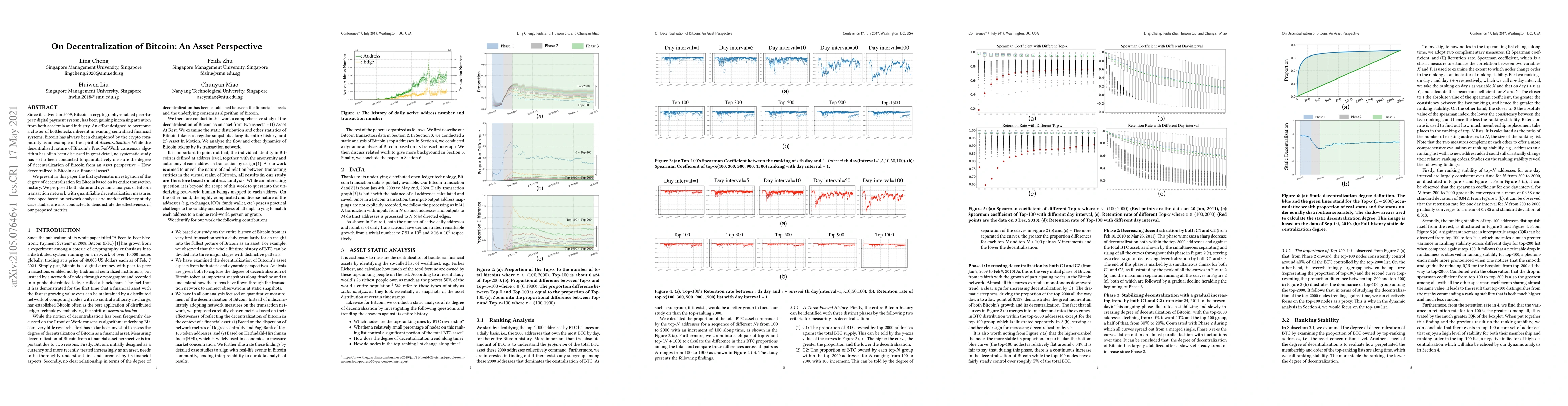

Since its advent in 2009, Bitcoin, a cryptography-enabled peer-to-peer digital payment system, has been gaining increasing attention from both academia and industry. An effort designed to overcome a cluster of bottlenecks inherent in existing centralized financial systems, Bitcoin has always been championed by the crypto community as an example of the spirit of decentralization. While the decentralized nature of Bitcoin's Proof-of-Work consensus algorithm has often been discussed in great detail, no systematic study has so far been conducted to quantitatively measure the degree of decentralization of Bitcoin from an asset perspective -- How decentralized is Bitcoin as a financial asset? We present in this paper the first systematic investigation of the degree of decentralization for Bitcoin based on its entire transaction history. We proposed both static and dynamic analysis of Bitcoin transaction network with quantifiable decentralization measures developed based on network analysis and market efficiency study. Case studies are also conducted to demonstrate the effectiveness of our proposed metrics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Full-History Network Dataset for BTC Asset Decentralization Profiling

Qian Shao, Feida Zhu, Ling Cheng et al.

Cooperation among an anonymous group protected Bitcoin during failures of decentralization

Kevin Kim, Yossi Eliaz, Christoph Huber et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)