Summary

In this paper we propose the notion of continuous-time dynamic spectral risk-measure (DSR). Adopting a Poisson random measure setting, we define this class of dynamic coherent risk-measures in terms of certain backward stochastic differential equations. By establishing a functional limit theorem, we show that DSRs may be considered to be (strongly) time-consistent continuous-time extensions of iterated spectral risk-measures, which are obtained by iterating a given spectral risk-measure (such as Expected Shortfall) along a given time-grid. Specifically, we demonstrate that any DSR arises in the limit of a sequence of such iterated spectral risk-measures driven by lattice-random walks, under suitable scaling and vanishing time- and spatial-mesh sizes. To illustrate its use in financial optimisation problems, we analyse a dynamic portfolio optimisation problem under a DSR.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

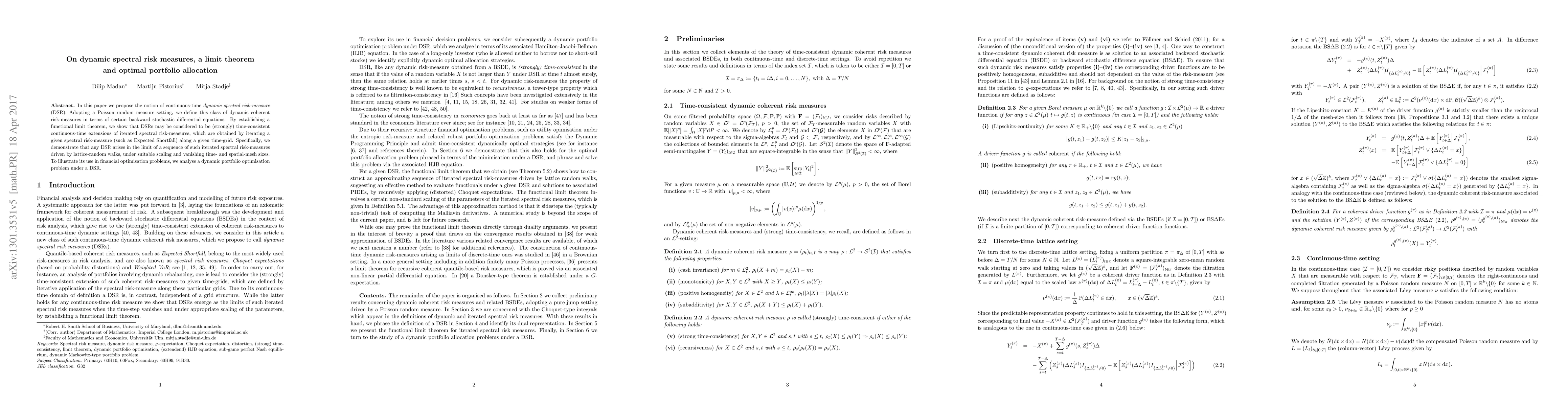

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Budgeting Allocation for Dynamic Risk Measures

Sebastian Jaimungal, Silvana M. Pesenti, Yuri F. Saporito et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)