Summary

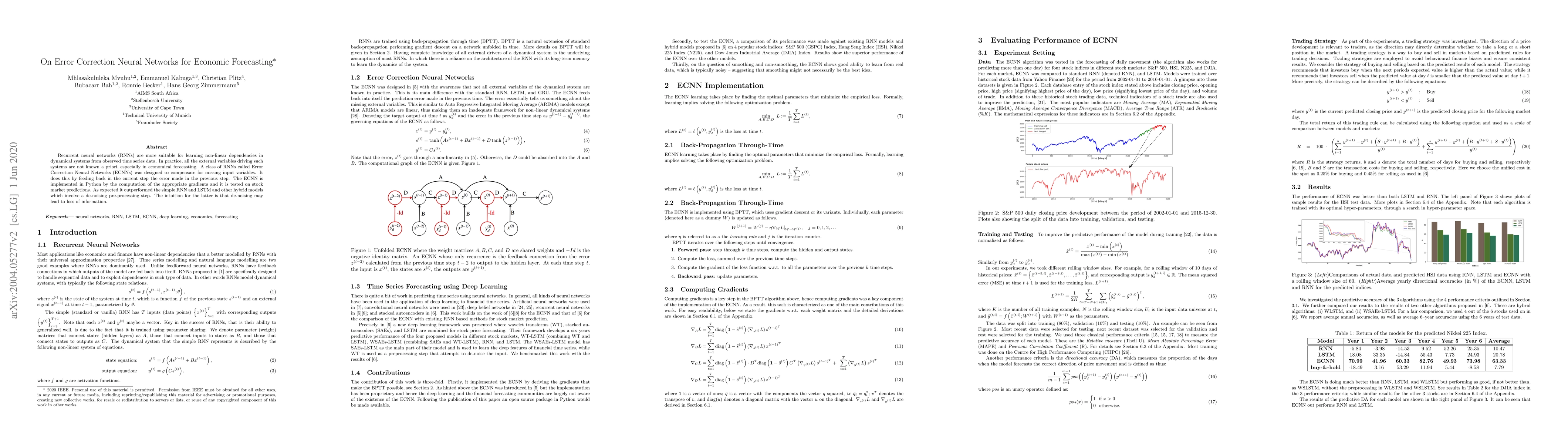

Recurrent neural networks (RNNs) are more suitable for learning non-linear dependencies in dynamical systems from observed time series data. In practice all the external variables driving such systems are not known a priori, especially in economical forecasting. A class of RNNs called Error Correction Neural Networks (ECNNs) was designed to compensate for missing input variables. It does this by feeding back in the current step the error made in the previous step. The ECNN is implemented in Python by the computation of the appropriate gradients and it is tested on stock market predictions. As expected it out performed the simple RNN and LSTM and other hybrid models which involve a de-noising pre-processing step. The intuition for the latter is that de-noising may lead to loss of information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline model error correction with neural networks: application to the Integrated Forecasting System

Marcin Chrust, Marc Bocquet, Alban Farchi et al.

Error-feedback stochastic modeling strategy for time series forecasting with convolutional neural networks

Kun He, Xinze Zhang, Yukun Bao

| Title | Authors | Year | Actions |

|---|

Comments (0)