Authors

Summary

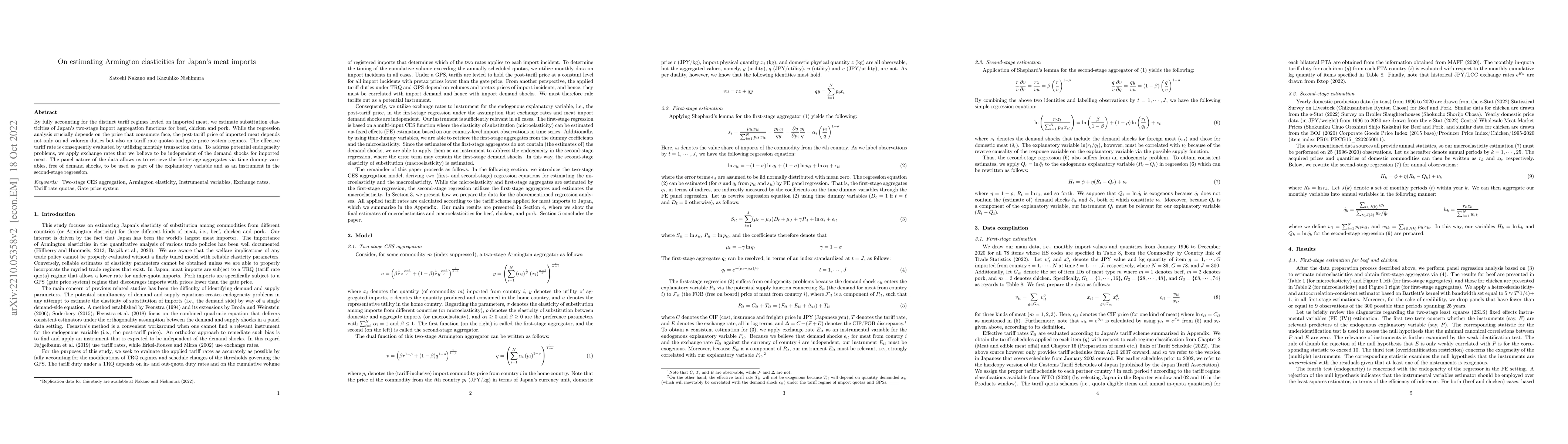

By fully accounting for the distinct tariff regimes levied on imported meat, we estimate substitution elasticities of Japan's two-stage import aggregation functions for beef, chicken and pork. While the regression analysis crucially depends on the price that consumers face, the post-tariff price of imported meat depends not only on ad valorem duties but also on tariff rate quotas and gate price system regimes. The effective tariff rate is consequently evaluated by utilizing monthly transaction data. To address potential endogeneity problems, we apply exchange rates that we believe to be independent of the demand shocks for imported meat. The panel nature of the data allows us to retrieve the first-stage aggregates via time dummy variables, free of demand shocks, to be used as part of the explanatory variable and as an instrument in the second-stage regression.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)