Authors

Summary

We consider the problem of fair allocation of indivisible goods to agents with submodular valuation functions, where agents may have either equal entitlements or arbitrary (possibly unequal) entitlements. We focus on share-based fairness notions, specifically, the maximin share (MMS) for equal entitlements and the anyprice share (APS) for arbitrary entitlements, and design allocation algorithms that give each agent a bundle of value at least some constant fraction of her share value. For the equal entitlement case (and submodular valuations), Ghodsi, Hajiaghayi, Seddighin, Seddighin, and Yami [EC 2018] designed a polynomial-time algorithm for $\frac{1}{3}$-maximin-fair allocation. We improve this result in two different ways. We consider the general case of arbitrary entitlements, and present a polynomial time algorithm that guarantees submodular agents $\frac{1}{3}$ of their APS. For the equal entitlement case, we improve the approximation ratio and obtain $\frac{10}{27}$-maximin-fair allocations. Our algorithms are based on designing strategies for a certain bidding game that was previously introduced by Babaioff, Ezra and Feige [EC 2021].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

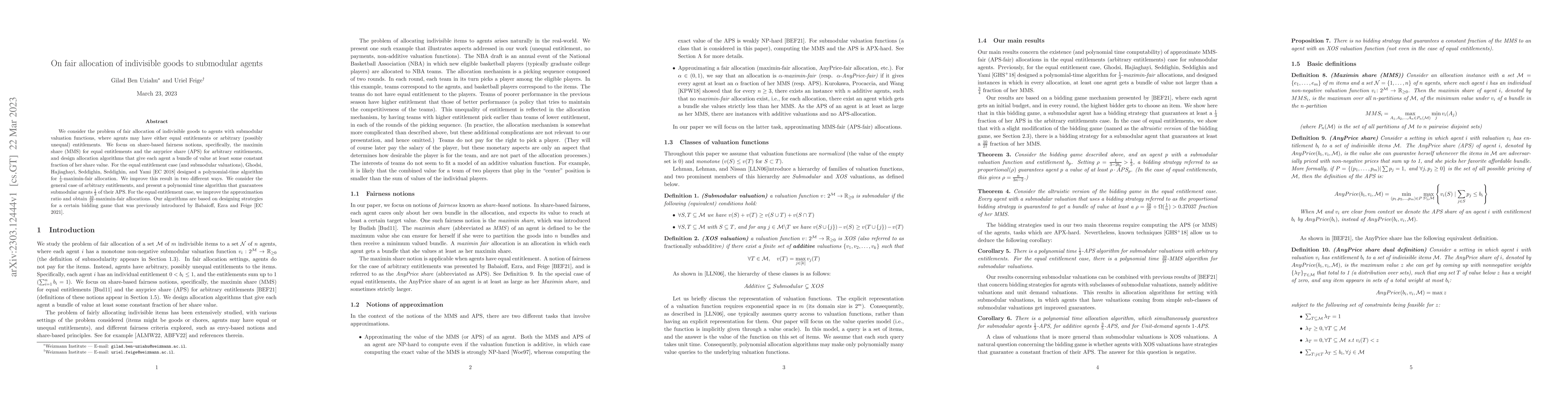

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)