Summary

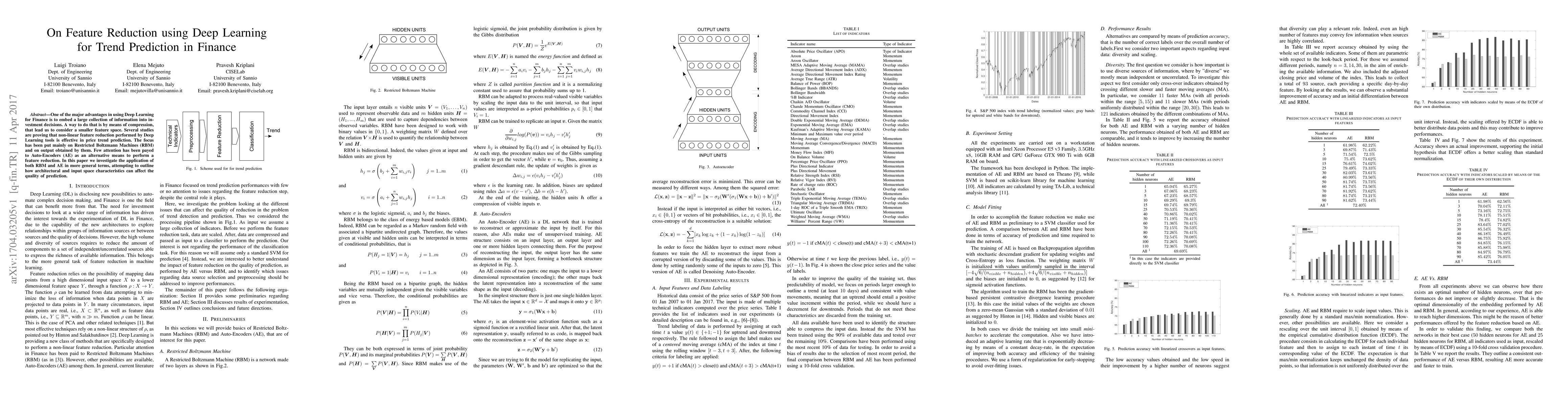

One of the major advantages in using Deep Learning for Finance is to embed a large collection of information into investment decisions. A way to do that is by means of compression, that lead us to consider a smaller feature space. Several studies are proving that non-linear feature reduction performed by Deep Learning tools is effective in price trend prediction. The focus has been put mainly on Restricted Boltzmann Machines (RBM) and on output obtained by them. Few attention has been payed to Auto-Encoders (AE) as an alternative means to perform a feature reduction. In this paper we investigate the application of both RBM and AE in more general terms, attempting to outline how architectural and input space characteristics can affect the quality of prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLOB-Based Deep Learning Models for Stock Price Trend Prediction: A Benchmark Study

Paola Velardi, Svitlana Vyetrenko, Leonardo Berti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)