Summary

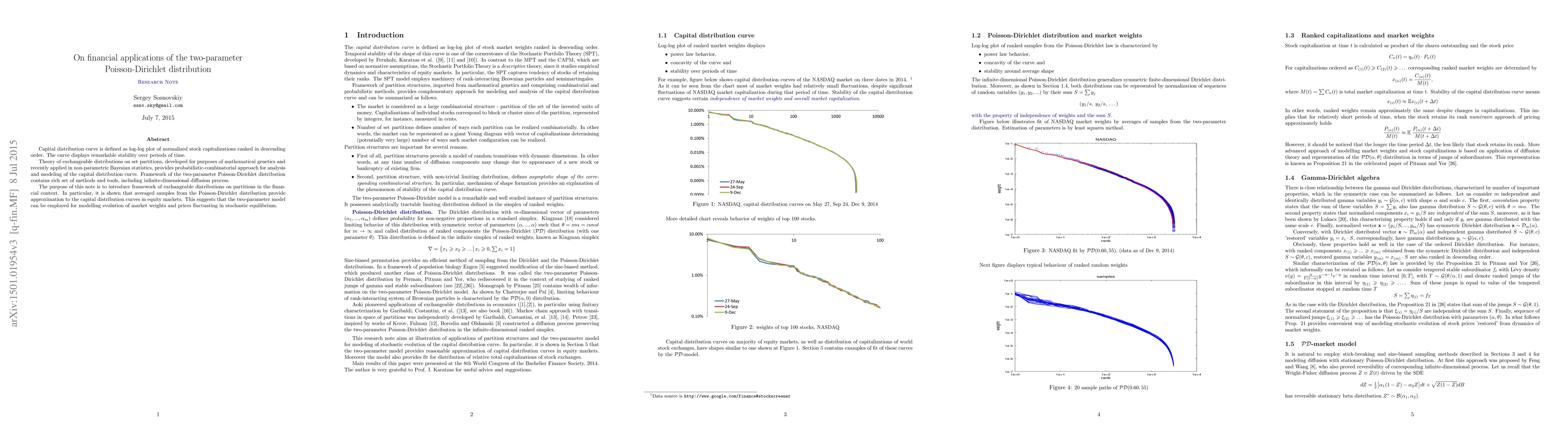

Capital distribution curve is defined as log-log plot of normalized stock capitalizations ranked in descending order. The curve displays remarkable stability over periods of time. Theory of exchangeable distributions on set partitions, developed for purposes of mathematical genetics and recently applied in non-parametric Bayesian statistics, provides probabilistic-combinatorial approach for analysis and modeling of the capital distribution curve. Framework of the two-parameter Poisson-Dirichlet distribution contains rich set of methods and tools, including infinite-dimensional diffusion process. The purpose of this note is to introduce framework of exchangeable distributions on partitions in the financial context. In particular, it is shown that averaged samples from the Poisson-Dirichlet distribution provide approximation to the capital distribution curves in equity markets. This suggests that the two-parameter model can be employed for modelling evolution of market weights and prices fluctuating in stochastic equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDual process in the two-parameter Poisson-Dirichlet diffusion

Dario Spano, Youzhou Zhou, Robert C. Griffiths et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)