Summary

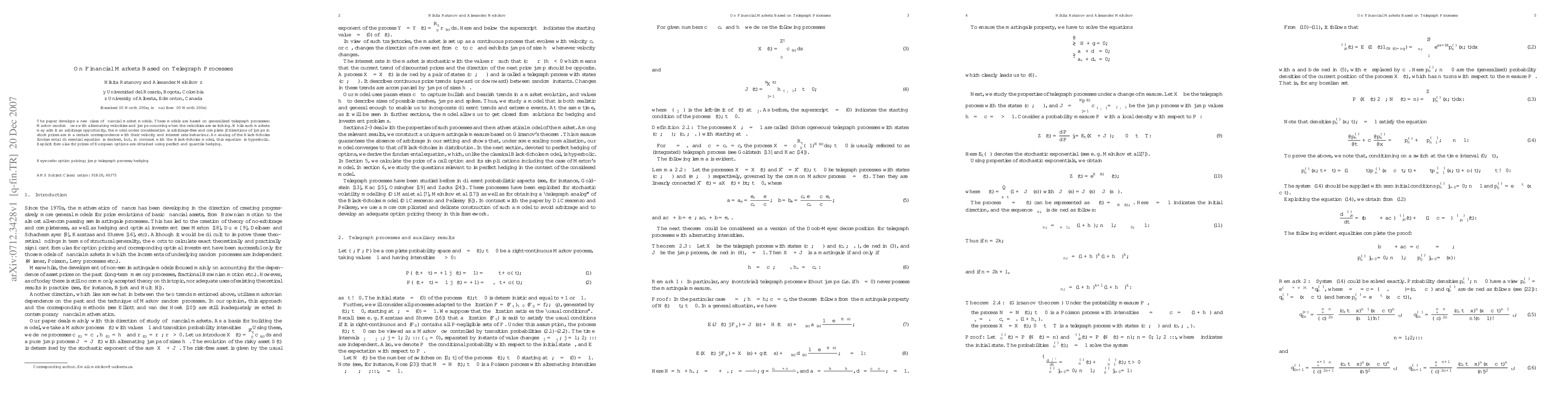

The paper develops a new class of financial market models. These models are based on generalized telegraph processes: Markov random flows with alternating velocities and jumps occurring when the velocities are switching. While such markets may admit an arbitrage opportunity, the model under consideration is arbitrage-free and complete if directions of jumps in stock prices are in a certain correspondence with their velocity and interest rate behaviour. An analog of the Black-Scholes fundamental differential equation is derived, but, in contrast with the Black-Scholes model, this equation is hyperbolic. Explicit formulas for prices of European options are obtained using perfect and quantile hedging.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA persistent-homology-based turbulence index & some applications of TDA on financial markets

José Carlos Gómez-Larrañaga, Miguel A. Ruiz-Ortiz, Jesús Rodríguez-Viorato

| Title | Authors | Year | Actions |

|---|

Comments (0)