Summary

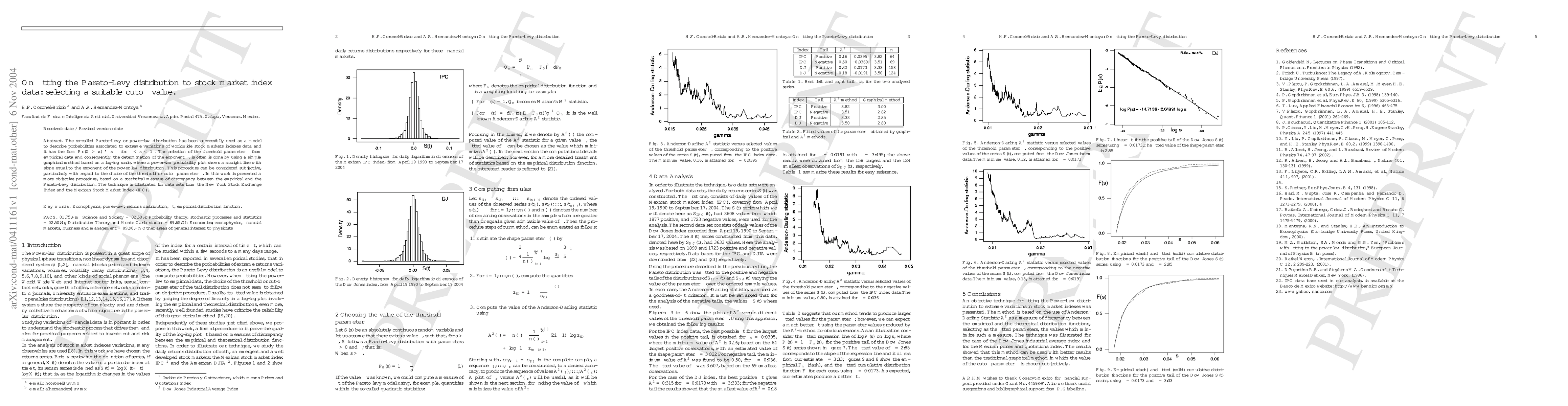

The so-called Pareto-Levy or power-law distribution has been successfully

used as a model to describe probabilities associated to extreme variations of

worldwide stock markets indexes data and it has the form $Pr(X>x) ~ x**(-alpha)

for gamma< x

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)