Authors

Summary

In this paper, we obtain a comparison theorem and a invariant representation theorem for backward stochastic differential equations (BSDEs) without any assumption on the second variable $z$. Using the two results, we further develop the theory of $g$-expectations. Filtration-consistent nonlinear expectation (${\cal{F}}$-expectation) provides an ideal characterization for the dynamical risk measures, asset pricing and utilities. We propose two new conditions: an absolutely continuous condition and a (locally Lipschitz) domination condition. Under the two conditions respectively, we prove that any ${\cal{F}}$-expectation can be represented as a $g$-expectation. Our results contain a representation theorem for $n$-dimensional ${\cal{F}}$-expectations in the Lipschitz case, and two representation theorems for $1$-dimensional ${\cal{F}}$-expectations in the locally Lipschitz case, which contain quadratic ${\cal{F}}$-expectations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

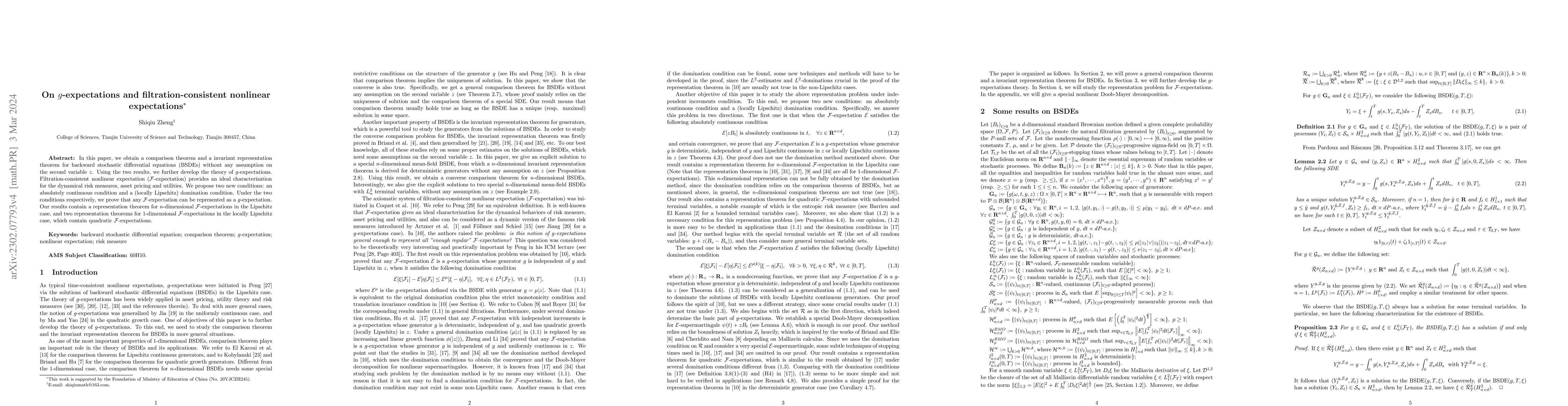

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)