Summary

We consider as given a discrete time financial market with a risky asset and options written on that asset and determine both the sub- and super-hedging prices of an American option in the model independent framework of ArXiv:1305.6008. We obtain the duality of results for the sub- and super-hedging prices. For the sub-hedging prices we discuss whether the sup and inf in the dual representation can be exchanged (a counter example shows that this is not true in general). For the super-hedging prices we discuss several alternative definitions and argue why our choice is more reasonable. Then assuming that the path space is compact, we construct a discretization of the path space and demonstrate the convergence of the hedging prices at the optimal rate. The latter result would be useful for numerical computation of the hedging prices. Our results generalize those of ArXiv:1304.3574 to the case when static positions in (finitely many) European options can be used in the hedging portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

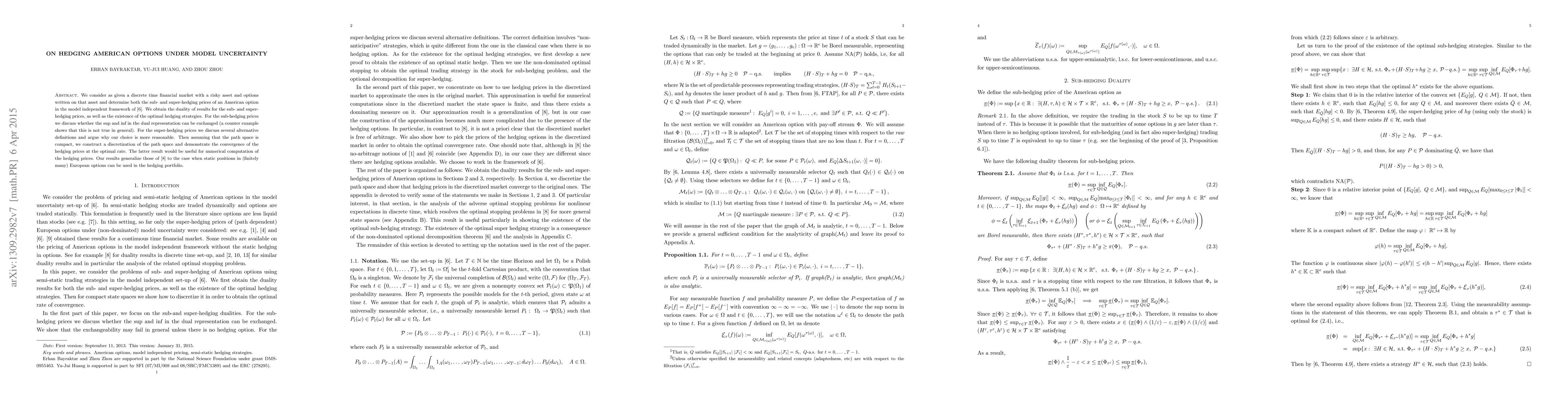

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)